·

+1-855-222-6993

·

[email protected]We are reader-supported. If you buy through links on our site, we may earn a commission. Learn more.

- Home

- About

- How To Invest In Gold

- Best Gold IRA Companies

- Crypto IRAs

- Blog

Do you want to know what a gold 401(k) rollover is and how to easily roll over your 401(k) into gold?

In a market as volatile as the one we are experiencing right now, your priority should be to protect the purchasing power of the money you have. If you have accumulated wealth for yourself, you need to learn how to protect it.

Now, more than ever!

With that said, let us start by explaining what a gold 401(k) rollover is and how you can easily roll over parts of your 401(k) into gold.

A gold 401(k) rollover is a process, where you roll over parts of your 401(k), 403(b), TSP, or similar retirement account into a gold-backed self-directed IRA (Individual Retirement Account).

A gold 401(k) rollover is a process, where you roll over parts of your 401(k), 403(b), TSP, or similar retirement account into a gold-backed self-directed IRA (Individual Retirement Account).

As mentioned, you can do this completely tax and penalty-free. As long as the gold 401(k) rollover occurs within 60 days, there are no tax consequences.

In other words, 401(k) plans and traditional IRAs allow you to avoid paying taxes on your contributions. So, if you want to diversify your account, you can invest some of your 401(k) funds in gold.

Additionally, moving your retirement funds into a self-directed IRA gives you the potential for more investment options. Except for precious metals, you can also invest in real estate, private bonds, and private equity.

Opening up a gold IRA account has many benefits, and can, for example, help you:

Gold and silver can weather numerous economic changes, giving your portfolio diversity and stability. History has shown that the price of precious metals often increases in tough economic times, just like today. Meaning that your portfolio has extra insurance against the woes of a financial crisis.

Also, unlike a corporation, gold cannot go bankrupt. No matter what happens to the economy, your tangible coins and bullion will still be sitting in your vault.

Let us move on to explaining what a self-directed IRA is and its key features next.

Our goal is to provide you with the most accurate and reliable information to help you identify the best option to grow and protect your wealth today.

With careful and extensive research, we have reviewed and rated the 5 best precious metals IRA companies of 2023 to help make your decision easier!

>>See our list of the 5 top precious metals IRA companies (cash sales also available).

Also, check out a time-limited special promotion from our #1 recommended company!

For a limited time, they are offering up to 10% of your order in FREE silver! Meaning that if you purchase metals for $100,000, you get $10,000 in FREE silver!

>>Learn more about this special promotion here!<<

Rating Overview From The Same Company:

A self-directed IRA is a variation of a traditional IRA or Roth IRA. In a self-directed IRA, you can hold a variety of alternative investments, including physical gold and silver, which regular IRAs cannot own.

Being that, here are the key features of a self-directed IRA:

So, now that you know what a self-directed IRA is, let us also take a look at the difference between a 401(k) and an IRA.

The main difference between a 401(k) and an IRA is that an IRA is normally opened by you rather than being offered by an employer.

The main difference between a 401(k) and an IRA is that an IRA is normally opened by you rather than being offered by an employer.

With a rollover IRA, you can use existing retirement funds to take advantage of a broader range of investments than are available through 401(k) investments alone.

Also, when performing an IRA rollover, funds from existing accounts can be rolled over into a new IRA tax-free. And you can even roll over funds from multiple retirement accounts into a single self-directed IRA. This makes it easier for you to consolidate and manage your retirement savings.

Moreover, a traditional IRA can also be rolled over into a gold IRA. And if you invest in a Roth gold IRA (meaning you own physical gold, which we always recommend), you will not be taxed at all on the gains on your gold investments.

No, it does not matter who currently hosts your 401(k).

Let us explain this a bit further:

And once the funds from your 401(k) have been deposited in an IRA, you can use them to buy gold or silver, or other metals.

Note that in a gold 401(k) rollover, the money being moved is paid to you. And you then deposit the funds in the other account.

You also have the option to transfer your 401(k) to a gold IRA. For more details, please visit our ultimate gold IRA rollover guide.

Now, let us look closer at how to own gold in an IRA and how to easily start one.

When you own physical gold or silver in an IRA, the gold coins or gold bars must be held by the IRA trustee rather than the IRA owner.

Section 401(k) of the Internal Revenue Code allows you as the account owner to make contributions to a retirement account in a tax-deferred manner.

This means that you will not be taxed on that contribution until you decide to take a distribution after retiring at age 59 1/2 or later.

As mentioned, in order to avoid IRS penalties and taxes, you will need to have your gold and silver stored at a custodian. The custodian provides safekeeping for your precious metals. As well as provides easy access when you do finally need to take possession of your precious metals.

You can choose your preferred custodian, but in most cases, your gold IRA provider will recommend an established custodian such as Brink’s, the Delaware Depository, or IDS.

These custodians all have a similar set of bonuses:

No matter what gold dealer you choose for your gold 401(k) rollover, they can help you complete the necessary paperwork to set up a new IRA.

They will also ship your gold coins or gold bars to a custodian on your behalf. And if at any time that you wish to deposit more precious metals, they can help you with that too.

By doing a 401(k) rollover, you can get more investment options. Often, you can save on fees as well. Employer plans often have high fees, so switching plans can save you a lot of money.

The government allows you to own multiple 401(k) plans and IRAs. This is important because it means you are able to create a solo 401(k) or self-directed IRA for precious metals. The trustee will be the custodian of the physical metals and your broker.

When you use a gold IRA or 401(k), you can buy and sell gold. To do this, you must follow certain government standards. Self-directed 401(k) plans and gold IRAs do not allow you to physically hold the gold yourself.

The actual gold IRA setup process is easy:

Step 1. Create your new IRA with a self-directed IRA custodian.

Step 2. Fund your account with dollars from your existing retirement account.

Step 3. Buy gold or silver, and your gold IRA provider will send your order to their preferred storage facility that meets IRS requirements.

The whole gold IRA rollover process takes about 10 days from start to finish.

All gold IRA companies on our list are well-established, reputable companies that have helped Americans protect their retirement savings for decades.

However, our two top options based on factors like BBB ratings, customer reviews, and years in business are either Goldco or Augusta Precious Metals.

They are both top-ranked gold IRA companies in the United States that we have carefully vetted.

If you want more details, please check out our in-depth reviews of Augusta Precious Metals and Goldco, where we have reviewed their products and services, fees, customer ratings and complaints, pros and cons, investment minimums, buy-back programs, promotions, and much more.

If you feel that a gold IRA is not for you, but you would like to grow your wealth with gold and silver trading, we then recommend that you choose BullionVault as your trading company.

Not only is BullionVault an award-winning worldwide online gold dealer, but also the biggest online gold and silver trading company in the world.

A question we get frequently…

…what if I want to invest in cryptocurrencies or a mix of digital assets and precious metals?

Of course, you can do that too!

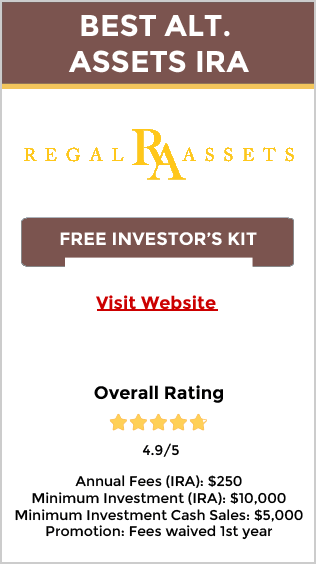

For example, Regal Assets is rated the best alternative assets company of 2022, and they allow you to include both asset classes in an IRA. But if you only want to include Bitcoin and other cryptocurrencies, BitIRA is the digital IRA company we recommend.

Note: before you make your investment you should make sure you do your homework and get the best information available.

We believe it is. Throughout history, gold and silver prices have moved in the opposite direction of paper assets and can, therefore, provide a good hedge against inflation. Past performance doesn’t guarantee future gains, but the numbers show that the weaker the dollar has become in the past, the better gold generally has performed. In fact, the relationship between gold and the dollar is often seen as an inverse one.

Traditional IRA accounts may not be enough to provide for you and your loved ones, post-retirement. Not if the economy remains as uncertain as it has looked recently.

For eons, investors have looked to gold to help them potentially offset losses due to economic turmoil. A gold IRA or precious metals IRA permits you to diversify a portion of your retirement portfolio — including pre-existing IRAs and former 401k(s) with previous employers — by actually owning physical gold (and silver) within a retirement plan. As a result, you can securely possess physical precious metals in a tax-deferred account.

Indirect forms of investing in gold are much riskier than physical metal. You are relying on any third party individual or company to look after your wealth for you, and depending on the company’s success or failure, you risk losing your investment. With physical gold, you are in control of your wealth. Physical gold offers you that layer of protection and security which Gold Exchange Traded Funds (ETFs), gold mining stocks and funds do not.

When investing in a gold IRA, you will get the same tax benefits as a traditional IRA, while actually owning physical gold coins or gold bars.

While some coins can be included in precious metals IRAs, only certain coins are IRS approved for inclusion in IRAs. In fact, not all bars or bullion are IRS approved. The IRS maintains a list of acceptable forms of precious metals for IRAs. You can be certain that a reputable gold IRA company offers a variety of metals for IRAs within IRS guidelines.

Yes. While established gold IRA companies often recommend Equity Trust as their preferred custodian and Delaware Depository for storage, you can choose your own custodian and storage companies.

Non-IRA precious metals, yes. Not metals for an actual IRA. IRS rules forbid keeping your IRA precious metals at home or in a standard safety security box. They must be held by an approved non-bank trustee or a bank within IRS guidelines that restricts access. In other words, just like a traditional IRA, the access to the precious metals in your precious metals IRA must be restricted in specific ways to ensure deposit and disbursement laws are followed.

No. Like all investments, the future value of precious metals is not guaranteed and can rise or fall based on a variety of market influences. But we believe physical precious metals are your safest bet to hedge against a stock market crash, inflation, and the debasing of the dollar.

At age 59½, you or the beneficiary of your precious metals IRA can start taking penalty-free distributions from the account, according to the IRS.

Usually around two-three weeks, although each application is different and the amount of time varies on a case-by-case basis.

The customers will receive top-notch service and specialized account setup knowledge provided by the gold IRA company’s IRA Processing Department throughout the process from start to finish. They do 95% of the paperwork with them. Customers can feel safe knowing they will be kept up to date every step of the transfer process by daily calls or e-mails from the IRA Processing team with any gold IRA company listed on How To Invest Gold. These companies also often provide lifetime account support.

For over a decade, our mission has been to provide investors and retirees with all the information they need when it comes to precious metals and cryptocurrency investing.

Not only do we provide a complete guide on the best ways to invest in precious metals, but we have also carefully vetted the best precious metals companies in the US to help you choose the best provider for your investment needs.

Not only do we provide a complete guide on the best ways to invest in precious metals, but we have also carefully vetted the best precious metals companies in the US to help you choose the best provider for your investment needs.

We believe that investing in precious metals and cryptocurrencies through your 401(k)/IRA is one of the best ways to invest in this asset class, due to the tax-saving component. A gold IRA or crypto IRA is the best way to protect your retirement account against an unstable market.

Disclaimer: The owner of this website is not licensed as an investment advisor and, accordingly, does not make any recommendations regarding clients’ personal investment portfolios. It is recommended that you carefully evaluate and research the risks and rewards associated with investing in alternative assets such as physical precious metals and cryptocurrencies before you make a purchase. Learn more in our Terms of Service.

+1-855-222-6993