In the midst of remarkable gains and soaring numbers in the Nasdaq (up over 30%) and the S&P 500 (nearly a 20% increase), a warning bell tolls from none other than investing legend Warren Buffett.

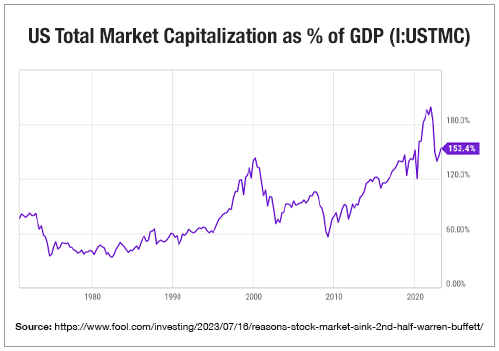

Enter the “Buffett Indicator,” his favored market gauge now flashing red signals. It suggests that stocks might be overvalued, casting a dark shadow of a potential crash ahead.Experts Echo The Buffet Indicator

With the indicator hitting a staggering 171%, it reflects the exuberance of investors who bank on artificial intelligence, anticipated rate cuts, and the hopeful scenario of a soft landing. Buffett, known for endorsing this gauge as “probably the best single measure” of stock valuations, raises concerns that have grabbed attention.

And he’s not alone. Experts echo this warning, painting a cautionary picture of the current state of the stock market. So, what can you do to protect your retirement funds? Now is the time to take proactive measures and safeguard your investments before it’s too late.

The indicator used by investors to gauge the overall value of the stock market relative to the size of the national economy is calculated based on the total market capitalization of all actively traded US stocks. This figure is then divided by the official estimate for quarterly gross domestic product (GDP).

According to Buffet, stocks would be considered fairly valued at a reading of 100%. However, he advises aiming to buy them at a lower range of 70% to 80% to avoid potential risks. It is crucial not to approach the 200% mark, as this would be akin to playing with fire.

Currently, the gauge is calculated using the Wilshire 5000 Total Market Index to determine the value of all traded stocks. The index has seen a significant jump of 22% this year. As a result, the market capitalization now stands at an impressive $46.32 trillion. This value is divided by the GDP estimate of $26.84 trillion from the Bureau of Economic Analysis, yielding a startling measure of 171%.

Historically, this gauge has proven accurate, as it decreased from over 210% in January 2022 to below 150% by September as stocks experienced a corresponding decline.

Why Will The Market Crash?

The market potentially crashing can be attributed to several factors. Firstly, overinflated valuations have become evident, as indicated by the Buffet Indicator, suggesting that stocks are currently expensive overall. In fact, the current levels have not been seen since the dot-com bubble in the early 2000s, except for a period between 2020 and 2021.

Moreover, recession forecasts contribute to the concern. Although the Fed is confident about avoiding a recession and achieving a ‘soft landing’, 63% of economists in a recent Bloomberg survey still anticipate an economic downturn within the next 12 months. It is worth noting that the stock market often starts to decline even before the economy does.

Another factor to consider is the money supply. The M1 money supply encompasses physical currency, while the M2 money supply includes deposits in savings or money market accounts. Historical patterns have shown that whenever the M2 money supply has dropped by 2% or more, a major economic downturn has followed, including instances like the Great Depression. Currently, the M2 money supply has decreased by more than 4%. If history is any indication, a recession could be on the horizon.

If you want to learn more about how to protect your wealth with gold and silver, you can request a >>>FREE 2023 Information Kit.

S&P 500 Faces A 64% Collapse

Furthermore, prominent figures such as Warren Buffet and John Hussman share a pessimistic outlook. John Hussman, an asset-bubble expert and President of Hussman Investment Trust, believes that the S&P 500 faces a 64% collapse due to extreme valuations and unfavorable market internals.

Considering recent developments, the stock market has witnessed a remarkable rally in 2023, with the S&P 500 soaring by 19% thus far. This surge, coupled with the price-earnings ratio climbing from last year’s lows near 19.6 to approximately 26, signifies the growing interest in AI, fading recession fears, and a decline in inflation.

Hussman asserts that a significant stock plunge is necessary to restore market conditions to normalcy, summarizing the situation by stating,

“Yes, this is a bubble in my view. Yes, I believe it will end in tears.”

In conclusion, the market’s potential crash is influenced by various factors that are worth considering for investors.

“Rich Dad, Poor Dad” author Robert Kiyosaki also warned about a collapsing market.

He tweeted, “too many signs point to a severe stock market crash. If your future depends on stocks and bonds, please be careful, possibly ask for professional advice.” He continued, “Afraid depression coming.”

How To Protect Your Savings

Protecting your financial future is of utmost importance. But how to best do that in today’s volatile market?

While many investors are riding the current stock market wave, it’s essential to heed the warnings of some of the world’s most preeminent investors.

Warren Buffet, for instance, suggests that attempting to time the market is futile. Instead, he’s allocating Berkshire Hathaway’s assets to cash and long-term investments, focusing on the future.

As you consider your investment strategy, it’s worth noting that physical gold is widely regarded as one of the most secure long-term assets. A Gold IRA can help to safeguard the value of your portfolio against potential stock market crashes.

If you want to learn more about how to protect your wealth with gold and silver, you can request a >>>FREE 2023 Information Kit.