As global markets teeter on the cusp of volatility, central banks have been taking a seemingly counter-intuitive approach by ramping up their gold purchases. This surge in demand for the precious metal begs the question on every prudent investor’s mind—why do central banks buy gold right now?

Understanding the rationale behind this move may not only offer an intriguing look at modern monetary policies but also serve as a beacon for individual investors weighing the benefits of jumping on the gilded bandwagon.

The Gold Standard Of Security

Despite no longer being tied to fiat currencies, gold continues to be prized by central banks around the world for its historic and intrinsic value. In times of economic uncertainty, gold is seen as a safe haven.

Despite no longer being tied to fiat currencies, gold continues to be prized by central banks around the world for its historic and intrinsic value. In times of economic uncertainty, gold is seen as a safe haven.

It’s a store of value that can effectively hedge against inflation and currency depreciation. Unlike paper assets or digital entries, the physical gold held by central banks is immune to hacking and technological risks, making it a highly secure asset.

Diversification & Stability

For central banks, holding gold is an essential strategy for diversifying reserves. In contrast to holding foreign currencies, which are subject to the fiscal and monetary policies of their country of origin, gold maintains independence.

It’s a form of insurance against geopolitical risks and fluctuations in the international markets. Thus, increasing gold reserves provides central banks with a stabilizing force that can be particularly reassuring to economies during periods of strain.

Why Investors Should Echo Central Bank Strategy

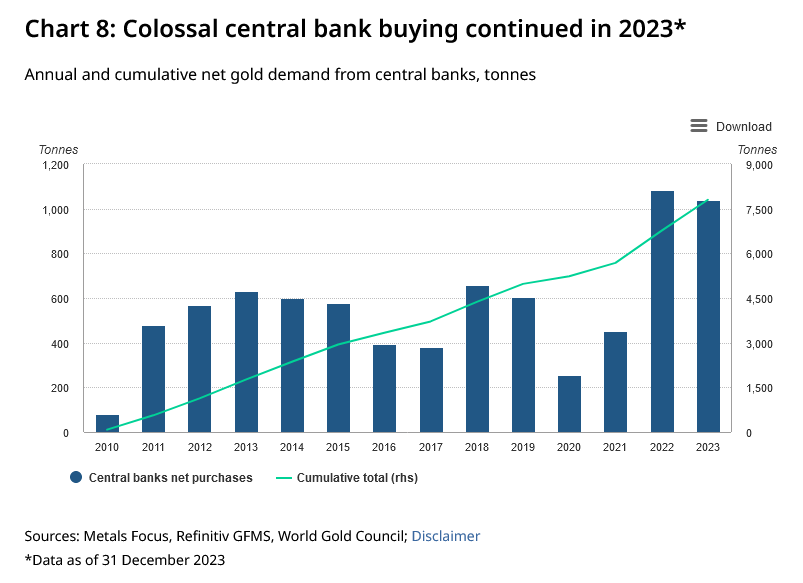

According to the World Gold Council, central banks collectively bought 337t gold in Q3 of 2023, the second-highest third quarter on record. On a y-t-d basis, central banks have bought an astonishing net 800t, 14% higher than the same period last year.

Online gold trading platform, BullionVault, suggests that central bank gold buying has risen by more than one-half by weight over the past 3 years compared with the previous 12 calendar quarters.

The People’s Bank of China (PBoC) regained the title of the largest buyer globally, increasing its gold reserves by 78t during the quarter. Since the start of the year, the PBoC has increased its gold holdings by 181t, to 2,192t (equivalent to 4% of total reserves).

“China may be buying gold to reduce its exposure to US Dollars and, consequently, to the possibility of sanctions,” says Michael Pettis, professor of finance at Guanghua School of Management at Peking University in Beijing.

Why Buy Gold Now?

Individual investors are taking cues from central banks for several reasons. Firstly, why buy gold now? Gold can serve as a hedge in any portfolio, offering a counterbalance against stock market crashes or economic downturns. As we observe central banks hoarding more gold, it serves as an indicator of economic sentiment among the fiscal authorities.

Secondly, the benefits of owning physical gold go beyond mere portfolio diversification. Unlike stocks and bonds, gold isn’t subject to the same level of volatility or market risk. It provides privacy and confidentiality in holdings, is highly liquid, and is worldwide accepted as a high-value asset.

Furthermore, as geopolitical tensions rise and currency wars loom, gold’s non-correlative nature to other assets becomes incredibly valuable. It doesn’t move with market trends or react to interest rate decisions, making it a powerful tool for preserving wealth.

Learn more about why you should buy gold right now and how you can rollover or transfer funds from your existing retirement savings account in this video:

Or, if you’re ready to take action >>>request this 2024 FREE Wealth Protection Kit and learn more about adding gold to your retirement savings account!

Navigating The Gold Rush Responsibly

While the surge in central bank gold purchases could be seen as a bullish signal for gold investors, it’s essential to conduct thorough research and consider overall investment goals and strategies. As with any investment, risks should be carefully evaluated against potential rewards.

Moreover, the logistics of investing in physical gold—such as storage and insurance—should be factored into the decision-making process. For those who prefer not owning physical gold in a gold IRA, there are various other instruments like gold ETFs and mining stocks that enable participation in gold’s economic benefits without the responsibility of physical ownership.

Additionally, if you prefer digital assets, a few select companies are licensed to also include specific cryptocurrency investments in an IRA. For crypto IRA investments, we recommend either BitIRA or My Digital Money.

In Conclusion

The golden verdict is clear: central banks are buying gold to fortify their economic arsenals in these uncertain times, and this move could be an intelligent play for individual investors as well.

However, the key is in understanding the implications of such investments and aligning them with personal financial strategies. As always, diversification is vital, and gold’s glittering allure should be carefully considered within the broader context of a robust, resilient investment portfolio.

Remember, investing in gold is not just about following the crowd; it’s about understanding the macroeconomic fundamentals that drive the demand for this time-tested asset. Be informed, be prudent, and may your investments always shine with the luster of well-placed confidence.

—

Are you exploring the idea of adding gold to your investment shine? What motivated the increase in gold purchases by central banks—and what could this mean for your investment strategy? Share your perspectives in the comments below or reach out to us for more insights into the burgeoning gold marketplace.

Before you go…

With careful and extensive research, we have reviewed and rated the 7+ best precious metals IRA companies of 2024 to help make your choice of precious metals provider easier:

>>See our list of the top 7+ precious metals IRA companies (cash sales also available)!