When it comes to protecting your retirement account against market volatility, inflation, and a pending recession, a gold IRA or precious metals IRA may be one of the best options at your disposal.

HowToInvestGold.com has reviewed and rated the 7 best gold IRA companies for 2026 to help you identify the best option to grow and protect your wealth today.A gold IRA is a specialized, self-directed individual retirement account designed to hold physical gold and silver, and other precious metals. Just like traditional IRAs, a gold IRA allows pre-tax contributions, meaning that the investment earnings can accumulate tax-deferred.

Opening up a gold IRA account has many benefits, and can, for example, help you:

- Help you hedge against tariffs, a weaker dollar, and inflation

- Limit exposure to economic uncertainty

- Mitigate the effects of geopolitical instability

- Diversify your portfolio

- Take real ownership of your financial future with a store of value

To learn more, check out this video about the benefits of investing in a gold IRA:

Now, let’s get back to our best gold IRA companies guide. Below, we have reviewed and rated the top 7 gold IRA companies in the industry to help you identify the best option to protect and grow your wealth today. Each company has been rigorously reviewed and vetted based on several critical factors:

-

- BBB/BCA Ratings and Complaints: We have analyzed Better Business Bureau and Business Consumer Alliance ratings and complaints to ensure the company’s credibility and reliability

- Customer Reviews: Real customer feedback provides valuable insights into the company’s service quality and customer satisfaction

- Annual Fees: Transparent fee structures can save you from unexpected costs

- Precious Metals Selection: A diverse range of investment options allows for a more tailored portfolio

- Storage Options: Secure and accessible storage is paramount for the safety of your investments

- Promotions: Special offers and promotions can add additional value to your investment

- Buy-Back Programs: Flexible buyback programs ensure liquidity and ease of selling your assets

Whether you’re a retiree looking to safeguard your nest egg, an investor seeking diversification, or a financial planner advising clients, this list is designed to help you find the most reliable precious metals IRA company for your needs:

Top 7 Gold IRA Companies For 2026

>

Here’s our list of the top 7 gold IRA companies (reviewed & rated), starting with our winner Birch Gold Group:

1. Birch Gold Group: Best Gold IRA Specialist

2. GoldenCrest Metals: Best For Integrity & Trust

3. Goldco: Best Customer Service & Experience

4. Augusta Precious Metals: Best For High-Income Investors

5. Noble Gold: Best For Personalized Service

6. American Hartford Gold: Best For An Extensive Product Assortment

*7. BullionVault: Best Online Gold & Silver Trading Company

#1. Birch Gold Group: Best Gold IRA Specialist Available

First on our list of the best gold IRA companies for 2026 is Birch Gold Group. With over two decades in business, we can safely state that Birch Gold Group is an established and highly reputable gold IRA company.

Like the previous gold IRA companies, they have an A+ rating with the BBB and an AAA rating with the BCA. They’ve also managed to earn thousands of 5-star reviews, with more than 15,000 clients across the US.

The company’s educational, no-pressure sales approach and easy and stress-free gold IRA setup make them an excellent choice for a gold IRA company.

In addition, Birch Gold Group has been endorsed by Ben Shapiro, Steve Bannon, Dan Bongino, and many more popular political commentators and featured regularly in major news and media outlets. For instance, the partnership with Mr. Shapiro allows the public to learn more about their retirement savings options since Mr. Shapiro’s thoughts are that …

Mr. Shapiro even helped bring to the fore the option to rollover an IRA or eligible 401(k) into an IRA backed by physical gold and silver.

Lastly, Birch waives all setup fees for new accounts over $50,000, plus shipping fees on all cash purchases of $10,000 and more. Not to forget, their buy-back program makes it easy to liquidate your metals when it is time to sell.

Birch Gold Group Gold Coins And Bars

- American Buffalo Coin

- American Gold Eagle

- American Gold Eagle

- Canadian Gold Maple Leaf

- Austrian Philharmonic Coin

- Australian Nugget/Kangaroo Coin

- Gold Gyrfalcon Coin

- Gold Polar Bear and Cub Coin

- Gold Rose Crown Guinea Coin

- Gold Twin Maples Coin

- Valcambi Combi Bars

- A Variety of Gold Bars and Rounds

Birch Silver Coins And Silver Bars

- America the Beautiful Silver Series

- American Silver Eagle

- American Silver Eagle

- Canadian Silver Maple Leaf

- Austrian Philharmonic Coin

- Australian Kookaburra Coin

- Mexican Libertad Coin

- Silver Gyrfalcon Coin

- Silver Polar Bear and Cub Coin

- Silver Rose Crown Guinea Coin

- Silver Twin Maples Coin

- A Variety of Silver Bars and Rounds

Platinum Coins And Bars

- American Platinum Eagle Coin

- A Variety of Platinum Bars and Rounds

Palladium Coins And Bars

- Canadian Palladium Maple Leaf Coin

- A Variety of Palladium Bars and Rounds

Birch Gold Verified Customer Reviews

Here’s a sample of Birch Gold Group’s recent customer reviews on Birdeye and Consumer Affairs:

#2. GoldenCrest Metals: Best For Integrity & Trust

In second place, we have GoldenCrest Metals, ranked as one of our best contenders in the gold IRA industry, despite its limited time in business. Launched at the outset of 2024 and led by CEO, Rich Jacoby, GoldenCrest Metals is charting a new course in redefining integrity and trust in an industry that has recently experienced its share of controversies. The firm’s commitment to transparent pricing and a non-aggressive sales approach has rapidly attracted a considerable client base in a notably competitive sector.

With opaque pricing mechanisms, misleading marketing tactics, and a lack of investor education and protection, GoldenCrest Metals set out to create a company that would redefine the standards of integrity and trust in gold investment. In other words, the company’s focus on transparency, honesty, and trust makes them stand out in an otherwise wildly debated industry when it comes to integrity.

What we like most about GoldenCrest is that they are a boutique firm with personal access to CEO, Jacoby, for any questions and concerns. Not many gold IRA companies give customers the phone number to the CEO.

In addition, they are accredited by the BBB and have already gathered many 5-star reviews on verified review sites such as Trustpilot and Google. We also like that the company operates on smaller margins to ensure investors get the most for their money. Investors and people saving up for retirement should consider giving this relatively new gold dealer a chance for their precious metals investment.

Popular Gold Coins

Canda Gold Maple Leaf

American Eagle Gold Coins

Gold American Eagle Proofs Coins

Gold Australian Striped Marlin Coins

Gold Australian Sea Turtle Coins

Gold Maple Leaf Coins

American Gold Buffalo Coins

Popular Silver Coins

Silver American Eagle Coins

Silver American Eagle Proof Coins

Silver American Bald Eagle Coins

Silver Australian Striped Marlin Coins

Golden Crest Metals Verified Customer Reviews

Here are examples of some customer reviews on Trustpilot and Google. Customers rave about how easy it is to work with GoldenCrest Metals in regard to their gold IRA rollovers:

#3. Goldco: Best Customer Service

Goldco is our third choice for the best gold IRA and precious metals company for 2026. We believe that the company has earned the spot as one of the leading and most trusted providers of precious metals IRAs in the United States.

For one, Goldco’s mission is to help Americans protect their retirement savings accounts from stock market volatility and inflation through the use of precious metals, which they have successfully been doing for over a decade.

The company’s specialty has always been the sale and delivery of premium gold and silver coins that are IRA-approved, and in helping you identify which precious metals are right for you.

Second, Goldco offers unmatched customer service and an easy and free IRA rollover, where a precious metals specialist at Goldco holds your hand from start to finish.

Also, their ZERO fees, no investment minimums, highest buyback guarantee, A+ rating by the Better Business Bureau, and AAA rating by the Business Consumer Alliance make them the best and safest option to open up your gold IRA account.

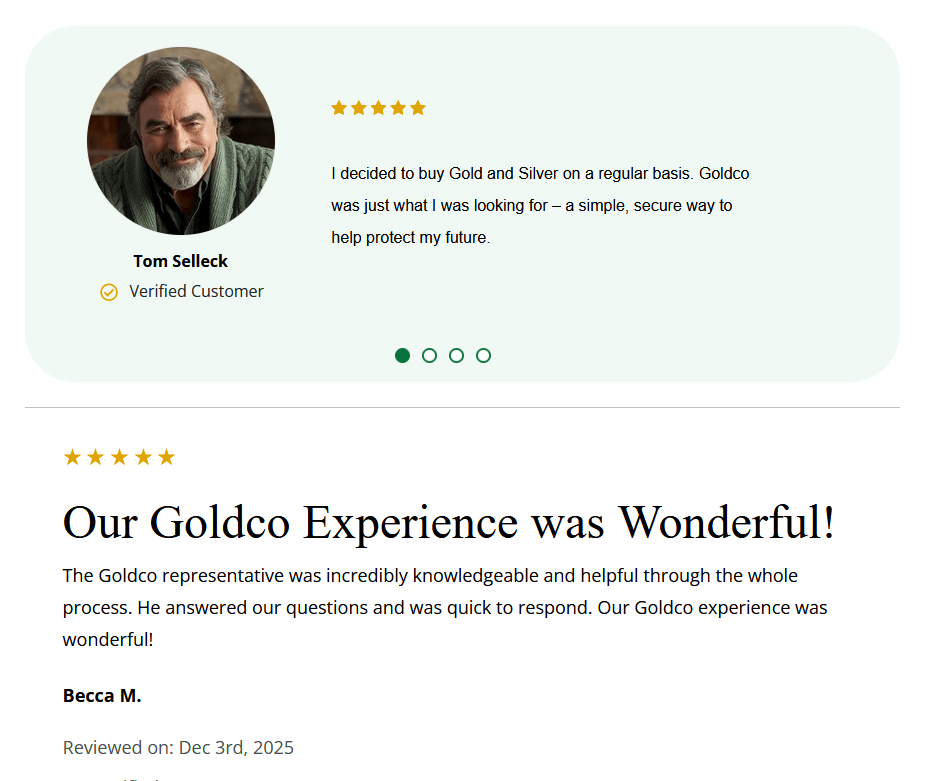

Additionally, Goldco was honored with the Gold Stevie Awards in 2024 and 2025 and was nominated as one of the Best Gold IRA Companies for customer service by Money Magazine this year. And in 2025, Sean Hannity, Tom Selleck, and Dennis Quaid continue to endorse Goldco and support the company’s growth initiatives to educate people about the benefits of buying gold and silver, as well as protecting their IRA, 401(k), TSP, or pension accounts with physical precious metals.

Goldco Gold Coins And Gold Bars

- Gold American Bald Eagle Coin

- Gold American Eagle Proof

- Gold American Eagle Coin

- Gold Buffalo Coin

- Gold Maple Leaf Coin

- Gold Lucky Dragon Coin

- Gold Australian Saltwater Crocodile Coin

- Royal Mint Gold Lunar Series: 2016-Year of the Monkey Coin

- Royal Mint Gold Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Gold Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Gold Lunar Series: 2019-Year of the Pig Coin

- Numerous PAMP Suisse and Perth Mint gold bars of various sizes

Goldco Silver Coins

- Silver American Bald Eagle Coin

- Silver American Eagle Coin

- Silver American Eagle Proof Coin

- Silver Lucky Dragon Coin

- Silver Maple Leaf Coin

- Silver World War I Coin

- Silver WWII Victory Coin

- Silver Australian Saltwater Crocodile Coin

- Royal Mint Silver Britannia Lunar Series: 2015-Year of the Ram Coin

- Royal Mint Silver Britannia Lunar Series: 2016-Year of the Monkey Coin

- Royal Mint Silver Britannia Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Silver Britannia Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Silver Britannia Lunar Series: 2019-Year of the Pig Coin

Goldco Verified Customer Reviews

Here’s a sample of some happy Goldco customers, including well-known actor Tom Selleck:

#4. Augusta Precious Metals: Best For High-Income Investors

Order the FREE Ultimate Guide to Gold IRAs

Fourth on our list of the best gold IRA companies for 2026 comes Augusta Precious Metals. The company is best for high-income investors who can invest $50K or more into a gold IRA or regular purchase.

Augusta has an excellent track record with hundreds of top reviews on watchdog sites like TrustLink and Trustpilot, as well as an A+ BBB rating and a AAA rating with the BCA. As a matter of fact, Augusta has been named:

-

- “Most-Trusted Gold IRA Company” by IRA Gold Advisor

- “Best Overall” Gold IRA Company in 2022-2025 by Money Magazine

- And received “Best of TrustLink” 6 years in a row

What also stands out is that the company offers the most unique approach to customer education via its personal one-on-one web conference designed by on-staff Harvard-trained economist Devlyn Steele.

To conclude, Augusta Precious Metals has a well-oiled process for making your gold IRA rollover or transfer stress-free and easy, together with IRA Specialists you can trust.

Augusta Precious Metals Gold And Silver Coins And Bars

- Gold American Eagle Proofs

- Gold American Eagle Coins

- Gold American Buffalo Coins

- Gold Canadian Eagle Coins

- Gold Canadian Maple Leaf Coins

- Australian Striped Marlin

- Gold or Silver Austrian Philharmonics

- Silver Canadian Eagle with Nest Coins

- Silver Canadian Soaring Eagle Coins

- Silver Canadian Maple Leaf Coins

- Silver American Eagle Coins

- Silver America the Beautiful Coins

- Gold or Silver Bullion Bars

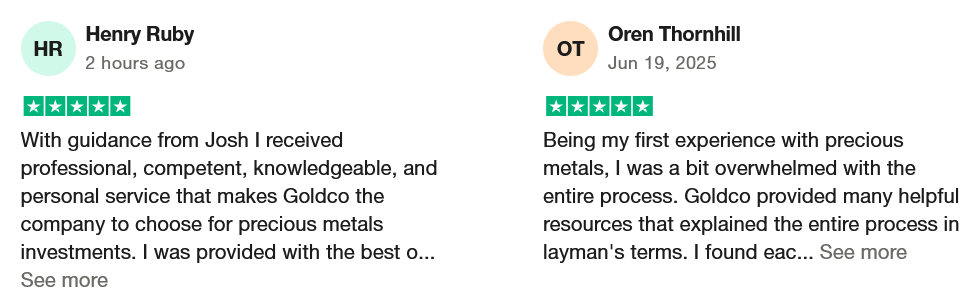

Augusta Precious Metals BBB Reviews

To give you an overview of what some of Augusta’s happy customers are saying, here’s a sample of the company’s BBB reviews:

#5. Noble Gold Investments: Best For Personalized Service

Making a name for yourself in the precious metals retirement investment sphere in just 7 years is not easy. And making a good name is that much harder. Noble Gold Investments has done just that. Despite their relative freshness as a brand, they consistently pop up as one of the top gold IRA companies available.

Noble Gold, based in Pasadena, California was established in 2017. Just like the other precious metals companies in this article, they focus on shielding Americans’ retirement savings from any number of economic calamities.

The company has an A+ rating with the BBB and an AA rating with the BCA, as well as remarkable customer reviews, practically spotless despite being in business for only 5 years. They also offer the best minimum IRA requirements in the sector, with $2,000 to open an IRA and a $5,000 rollover minimum.

Additionally, one of the stronger points of the company is the availability of IRA-eligible coins in numerous denominations. Likely due to their focus on precious metals dealership, they are able to offer IRA-eligible bullion in denominations that you simply will not find with most other gold IRA companies.

We also like that the company offers a FREE Masterclass on Gold Investments hosted by Kevin Sorbo from the movie Hercules. It teaches people how to create a bulletproof investment portfolio in economic crises.

Noble Gold Coins And Gold Bars

- American Eagle Gold Coin

- Canadian Gold Maple Leaf Coin

- Australian Gold Kangaroo Coin

- Australian Gold Philharmonic Coin

- Johnson Matthey 1 Kilo Gold Bar

- Perth Minth 10oz Gold Bar

- Pamp Suisse 100-Gram Gold Bar

- PAMP Suisse Lady Fortuna Gold Bar

- And more.

Noble Gold Silver Coins And Silver Bars

- 1oz American Silver Eagle Silver Coin

- 5oz America the Beautiful Silver Bullion Coin

- 1oz Canadian Maple Leaf Silver Coin

- Australian Silver Kangaroo Coin

- 1oz Austrian Silver Philharmonic Coin

- 1-kilo Australian Silver Coin

- 5oz Highland Mint Silver Bar

- 10oz Republic Metals Silver Bar

- 1oz Rand Refinery Silver Bar

- 100oz Republic Metals Silver Bar

- And more.

Noble Gold Customer Reviews

Here’s a sample of Noble Gold’s customer reviews on Trustpilot and the BBB:

#6. American Hartford Gold: Best For An Extensive Product Assortment

No Fees for the First 3 Years in IRAs With a Minimum Account Purchase of $100,000

$10,000 in FREE SILVER on Qualified Purchases

Sixth on the list of our best gold IRA companies for 2026 comes American Hartford Gold. The company is known for a great product selection and for putting its clients at the forefront.

Despite “only” being in business since 2016, the California-based company has processed over $1 billion in transactions. A massive figure that is corroborated by the sheer amount of reviews they have compared to even some of their top competitors.

American Hartford Gold’s President Scott Gerlis comes from a family with an interest in numismatics, coin collecting, and the like. We don’t need to tell you that such a background is going to go a long way when it comes to how products are treated, and indeed, as we gloss over the inventory, we’ll see that Gerlis’ claims of being a coin aficionado are very much valid.

The company’s personalized customer support, 100% free IRA rollover, transparent and competitive fee structure, a remarkable palette of gold and silver bullion, plus the fact that they are rare coin collectors and enthusiasts make them a great choice of gold IRA company.

Additionally, the company is ranked #1 for Inc 5000 in the Precious Metals Vertical and is also endorsed by longtime Fox News television host and political commentator Bill O’ Reilly. Not to forget, “America’s Mayor” and Donald Trump’s former lawyer, Rudy Giuliani, is also a client and sponsor of American Hartford Gold.

American Hartford Gold Coins And Gold Bars

- American Buffalo Gold Coins

- American Gold Eagle Gold Coins

- Canadian Gold Maple Leaf Gold Coins

- Austrian Gold Philharmonics Gold Coins

- Canadian Buffalo 2021 Gold Coins

- Canadian Gyrfalcon Gold Coins

- Australian Wildlife Gold Coins

- Saint Helena Sovereign Gold Coins

- 1 Ounce Gold Bar

- And more.

American Hartford Silver Coins And Silver Bars

- America the Beautiful Silver Series

- Saint Helena Sovereign Silver Coins

- American Silver Eagle Silver Coins

- Australian Wildlife Silver Coins

- Europa and the Bull Silver Coins

- South African Krugerrand Silver Coins

- Canadian Buffalo 2021 Silver Coins

- Canadian Gyrfalcon Silver Coins

- 2014 Canadian Arctic Fox Silver Coins

- A Variety of Silver Bars and Rounds

American Hartford Gold Trustpilot Reviews

To give you an overview of what American Hartford Gold’s customers are saying about the company, here’s a sample of their Trustpilot reviews:

*7. BullionVault: Best Online Gold & Silver Trading Company

As a bonus contender on our list of the best gold IRA companies for 2026 we present BullionVault. The company differs from our other precious metals companies in the sense that it is one of the largest online bullion dealers in the world. Even though their main focus is on gold and silver trading, the company offers precious metals IRAs as well.

With BullionVault, individuals can easily invest in gold, silver, and platinum that they can choose to store at home or in secure vaults in Zurich, London, Toronto, Singapore, or New York.

BullionVault is not rated by the BBB since the company is registered in the UK. However, BullionVault has excellent customer reviews and is seen as a trusted and respected online gold dealer, which has served its customers for over two decades.

Besides, BullionVault is partially owned by the World Gold Council, allowing customers to have direct access to the professional bullion market. We would say that BullionVault is the ideal precious metals dealer for international investors just starting out, as well as professional gold and silver traders.

BullionVault Gold Coins And Gold Bars

- Nugget/Kangaroo Gold Coin

- Philharmonic Gold Coin

- Britannia Gold Coin

- Sovereign Gold Coin

- Maple Gold Coin

- Krugerrand Gold Coin

- Eagle Gold Coin

- Gold Bars in Many Shapes and Sizes

Silver Coins And Silver Bars

- Britannia 1 Oz Silver Coin 2017

- Maple Leaf 1 Oz Silver Coin 2017

- American Eagle 1 Oz Silver Coin 2017

- Austrian Philharmonic 1 Oz Silver Coin 2017

- Chinese Panda 30g Silver Coin 2017

- Australian Kangaroo 1 Oz Silver Coin 2017

- Pamp 100g Silver Minted Bar

- Pamp 1kg Silver Cast Bar

- Valcambi 1000 Oz Silver Bar 2012

>>Request the FREE Ultimate Gold & Silver Guide

Now, let us cover some common questions and answers about opening a gold IRA account.

Common Gold IRA FAQs

Even though you have come this far to look for the best gold IRA companies to open a gold IRA account with, you may still have questions.

To hopefully answer all of them, we have listed some common questions and answers about gold IRAs. Feel free to use the quick links in the TOC list to jump straight to any section:

What Is A Precious Metals IRA?

To begin, a precious metals IRA, also called a gold IRA, is a specialized self-directed individual retirement account designed to hold physical gold and silver, and other metals.

Just like traditional IRAs, a gold IRA allows pre-tax contributions, meaning that the investment earnings can accumulate tax-deferred.

In contrast to a gold IRA, a regular IRA typically holds paper assets such as stocks, bonds, ETFs, and more.

Benefits Of A Gold IRA

In uncertain times like these, it is more important than ever to turn to assets that help you hedge against inflation and other economic stresses to help strengthen your savings.

Opening up a gold IRA account has many benefits, and can, for example, help you:

• Help you hedge against a weaker dollar and inflation

• Limit exposure to economic uncertainty

• Mitigate the effects of geopolitical instability

• Diminish negative fallout from the current recession

• Diversify your portfolio

• Take real ownership of your financial future

For more information, you can visit our articles on:

- How To Start A Gold IRA In 3 Simple Steps

- Gold IRA Rules: How To Protect Your Retirement With Precious Metals

- Gold IRA Tax Rules: The Ultimate Gold IRA Tax Guide For 2026

- How to Buy Physical Gold in an IRA: A Step-by-Step Guide for Future-Proofing Your Retirement

- Gold IRA FAQ: Everything You Need To Know About Gold IRAs

- Gold IRA Pros And Cons

Are There Different Types Of Self-Directed Gold IRAs?

Yes, there are two types of gold IRAs available:

1. Traditional-Based Gold IRA

With a traditional IRA, the contributions you make are tax-deductible (subject to income limitations). When you start taking distributions from your gold IRA, the amounts withdrawn are taxable as ordinary income. And you can start taking distributions without penalty when you are age 59½.

Traditional IRAs may be good choices for those individuals who anticipate finding themselves in a lower tax bracket once they reach retirement.

That way, they can realize tax benefits from their contributions during higher-bracket working years and pay taxes at a lower rate on withdrawals once they retire.

Note that a traditional IRA – including a traditional gold IRA – comes with a required minimum distribution (RMD) mandate. This means that you must begin taking annual distributions from your IRA starting at the age of 72.

2. Roth-Based Gold IRA

In contrast to a traditional IRA, with a Roth gold IRA, the contributions you make are NOT tax-deductible. This means there is no tax benefit generated from your account contributions that you will enjoy during your working years.

However, when you make withdrawals from your Roth IRA, you do not have to pay taxes on the distributions as you do with a traditional IRA.

Roth IRAs may be a prudent account choice for those individuals who believe the tax bracket they’re in during their working years is lower than the one they’ll be in once they retire.

They will not receive a tax benefit from their contributions while they’re still working, but they won’t pay taxes at all on their withdrawals during retirement when they’re in a higher tax bracket.

Additionally, there is no required minimum distribution feature for a Roth IRA. Something else to be aware of is that as of 2026, your modified annual income must be less than $168,000 as a single tax filer or $252,000 as a joint tax filer in order to contribute to a Roth IRA.

Please be aware that the guidelines presented here for both traditional and Roth IRAs are very broad. Before choosing between a traditional and Roth IRA, you should consult with your tax advisor to ensure you’re making the best decision on behalf of your own particular tax profile.

Do I Need To Pay Taxes On My Gold Or Silver IRA?

By investing in a gold IRA, you will diversify your retirement portfolio on a tax-deferred basis and maintain the tax preferential treatment.

For this reason, transferring or rolling over a portion of your existing IRA account into a gold IRA will not trigger any tax implications. In other words, you do not have to pay taxes on your contributions until you withdraw them.

However, there are limitations on how much you can contribute to these accounts each year, but these limits can change from year to year. Your gold IRA company will be updated on these rules.

What Are The Fees Of A Gold IRA?

A precious metals IRA or gold IRA often comes with higher fees than a traditional or Roth IRA that invests solely in paper assets.

Typically, there are 3 sets of fees charged with a gold IRA:

1. Account Setup Fee

The one-time account setup fee is around $50 to $150 but most companies waive this fee nowadays.

2. Admin/Custodial Fee

Except for the setup fee, there is also an annual administrative or custodial fee, ranging from $50 to $150 depending on the account’s size.

3. Storage Fee

Lastly, storage fees are also charged by the depository, ranging from $100 to $150 annually, depending on the amount of gold being stored. Plus, if you prefer segregated storage or non-segregated storage.

*4. How Do Gold IRA Companies Make Their Money

In most cases, companies charge a markup/commission to make money.

In most cases, companies charge a markup/commission to make money.

Instead of the regular commission for purchasing or selling gold, most gold IRA companies add a “markup” to the spot price, which is essentially their take to facilitate the transaction.

Should I Buy Gold Bars Or Gold Coins?

When purchasing gold for your gold IRA, you can choose between bullion bars and sovereign coins.

The IRS has established guidelines for metal “fineness” standards to determine whether gold or silver in the form of bullion bars or coins is acceptable for a gold IRA.

This means that the IRS only allows specific gold and silver coins and bars, such as:

This means that the IRS only allows specific gold and silver coins and bars, such as:

- Gold or Silver American Eagles

- Gold or Silver American Eagles (Proof coins)

- Gold or Silver American Buffalos

- Gold or Silver Canadian Maple Leafs

- Gold or Silver Austrian Philharmonics

- Silver America the Beautiful Coins

- Gold or Silver Bullion Bars

- American Silver Eagles

- And more.

No matter what bullion or coins you choose, a reliable gold IRA company knows what is and what is not acceptable for a gold IRA. While both are essentially valued in the same way—per ounce based on the spot price of gold, coins may be easier to trade and tend to sell at higher premiums than bullion bars.

Besides, the markups are often higher on small bullion bars. And large bars are more suited for institutional investors. However, all the gold IRA companies (listed above) offer favorable buy-back programs for both coins and bullion.

How Do I Fund My Gold IRA?

Opening a gold IRA is great, but having it funded with an existing plan is even better. All gold IRA companies listed in this article assist with performing rollovers of various kinds, including:

• The full or partial rollover of a 401(k) or similar retirement account

• The full or partial rollover of a 401(k), TSP, or similar inactive retirement account

• Rollovers of less common plans and accounts, such as SIMPLE or SEP IRA

When working with any of these gold IRA companies, rollovers are not as troubling as they may seem.

The rollover is handled by a specialist on behalf of the custodian company, as well as any administration that the gold IRA company may employ. And the new gold IRA can be funded by several IRAs or receive only part of the funds that would go into another IRA.

Can I Rollover My 401(k) Into Gold?

Yes.

In fact, many people who choose to invest in a gold IRA are using funds they acquired while using a traditional IRA or company-managed 401(k). Additionally, retirees also make the switch to gold with accounts they take with them upon leaving the workforce.

Many choose to roll over just a portion of their IRA or 401(k) to a gold IRA as a way to diversify their nest egg, which should always be the way to go. Learn more in our ultimate gold IRA guide.

Where Should I Store My IRA Gold?

IRS regulation has mandated that the bullion in your IRA rests with a certified depository, an entity separate from the custodian who will manage your daily paperwork. Needless to say, you cannot keep your IRA gold in a home safe, safety deposit box, or under the mattress.

Most gold IRA companies partner with different custodians that are carefully vetted and will make sure your metals are stored safely.

But if none of them are what you find suitable, you can introduce a depository of your own to the mix, provided it is compliant with regulations.

For example, Brink’s, the Delaware Depository, and IDS are fairly similar. While only IDS among the three offers segregated storage, all three have a similar set of bonuses:

• A standalone facility where the bullion is processed

• Both the facility and its vaults are managed using the best technology available to the depository

• They have security measures like high-defense vaults and electronic systems

• Adding to that, their assets are insured with a multi-fold policy

Generally, the company handles transportation logistics as well as insurance coverage.

Note: It is up to you to confirm that any company you invest with has all the required licenses, registrations, insurance, and bonds to protect your investment. So, ask for verification of those licenses and other information.

When Can I Take Distributions?

If you are at the qualified age to start getting disbursements from your account (usually 59 ½ ), you can choose to take funds in cash value. Or you can have the actual metals shipped to you directly

But be aware that you will be taxed accordingly and be responsible for any liability to the IRS for early withdrawals. The bottom line is that you should treat a gold IRA as a long-term investment for retirement and hold it to maturity.

Note: Remember that you have to start taking payments at 70 ½.

How To Start A Gold IRA

If you are interested in physical precious metals, starting a gold IRA is easy! Simply fill out this online application, and a precious metals specialist will contact you within 15 minutes. Filling out the short form will also grant you access to a Gold IRA Guide or Investment Kit that will be shipped to you for free. This comprehensive guide will give you all the information you need to make informed decisions about your investment.

To establish an account, you’ll need to provide personally identifiable information like your social security number. If you don’t have a precious metals custodian company, your chosen gold IRA company will help you set up an account with one of their preferred custodian companies.

This is the gold IRA setup process in short:

✓ Sign Your Agreement

To secure your precious metals purchase and understand the company’s terms of doing business, you will review, approve, and sign a standard customer agreement.

✓ Fund Your Account

There are different ways to fund your account, and those are typically either sending funds through a bank wire or simply mailing a check to the gold IRA company of your choice’s office.

✓ Select Your Precious Metals

As soon as you have funds in your account, it’s time to start thinking about which precious metals to add to it. You get to pick and then the gold IRA investment firm handles the shipping. Plus, you can choose to have your coins delivered to an independent insured depository, sent straight to you, or you might even qualify for free storage (ask your provider).

How To Manage The Precious Metals In Your Account?

After the account is open and funded, getting started can feel a bit prohibitive. Even the die-hard gold investor might find some disagreements over the coin denomination to invest in. Those with less intent can succumb to external factors more easily, and in finance, these are always within arm’s reach.

All precious metals fulfill the same purpose in your account relative to other assets. More than likely, they are a form of hedge and were bought with safety in mind. But relative to each other, precious metals can have very varied utility.

Reasons for wanting your gold IRA to include:

Gold

- The most defensive of the four and the safest pick. Gold has the least volatility to the downside, therefore often lacks explosive price action. It behaves remarkably in any crisis scenario, even when the setting is unprecedented

- The industrial aspect is present but limited. Though gold has plenty of utility and uses in manufacturing in a range of industries, it is mostly viewed as an investment metal. Even those buying gold jewelry often think about its pricing in weight down the line

- The widest range of investment options, in an IRA and outside it, and the most represented of the precious metals. Collectors and IRA investors alike will be strapped for choice when picking items from the inventory

Silver

- On the precious metals scene, oftentimes gold’s opposite. It is always both a safety play and a defensive one, as the metal never leaves this role on a broader scale. But within the precious metals spectrum, silver behaves differently from gold despite following its price

- Those who buy silver do not do it because it is cheaper than gold, as the saying goes, but because of its specific range of benefits. The metal has a huge manufacturing side, with green technology growing more popular. Any significant impacts in demand from the manufacturing sector would greatly benefit silver’s price. In 2025, the silver price has increased by over 140% due to its demand in the EV and AI industry, and silver is predicted to skyrocket in 2026

- A similarly varied range of investment options for gold, including many new and old coin varieties that can either be held in an IRA or outside it. Gold and silver both have a very pronounced sector of coin enthusiasts compared to the other two precious metals

Platinum and Palladium

- Within the context of precious metals, these could be considered industrial metals. They are every bit as volatile as silver, but for different reasons. Palladium’s valuations exceed gold these days. Meanwhile, platinum, historically gold’s equal in price, sits around roughly half its price

- Both platinum and palladium have a strained mine supply. Not a lot is being mined, and mining is highly localized. In palladium’s case, for example, nearly 40% of annual production comes from one country. This has contributed to the metal soaring to new all-time highs. Despite a dearth of supply, technologies making use of both platinum and palladium are on the rise

- One might think that platinum and palladium will have few investment options, but that is not the case. Besides a range of bars, plenty of investors are interested in sovereign coins made from either platinum or palladium

Final Thoughts: Building A Gold IRA That Lasts To Secure Your Savings

When it comes to your retirement, a gold IRA can help you diversify, protect, and grow your retirement savings account, as well as help you hedge against the effects of a weaker dollar, inflation, and geopolitical instability.

Even though your current investment situation and future goals are all unique, each of these gold investment companies has the expertise and knowledge to help you achieve the retirement of your dreams.

So, start by requesting any of these companies’ gold IRA information kits/guides, and a representative will reach out to you and provide you with all the information you’ll need to make the best investment choice for your future.

Before you go, you may want to check out our video on the secret wealth strategy billionaires use that anyone can replicate: