Thank you for visiting our Boston Bullion Review for 2026. In this review, we’ve taken a close look at Boston Bullion reviews and complaints, products, precious metals IRAs, fees, storage, pros and cons, and more to judge whether they are a legit company or a scam.

Our goal is to provide you with the most accurate and reliable information to help you identify the best option to grow and protect your wealth today.

With careful and extensive research, we have reviewed and rated the 7 best precious metals IRA companies for 2026 to help make your decision easier!

>>See our list of the top 7 precious metals IRA companies (cash sales also available).

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry

- Unmatched Customer Service

- No High-Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

- 2021 Company Of The Year Award

With that being said, let us now look at how Boston Bullion measures up!

Since this is a comprehensive review, please feel free to use the quick links in the TOC list to jump straight to any section:

Boston Bullion is a reputable precious metals dealer with a storied history that comes off as a mom-and-pop shop despite competing with some of the biggest names in the industry and doing it well.

Let’s get into what customers have to say before covering what the company is about on our own.

Boston Bullion Reviews

![]()

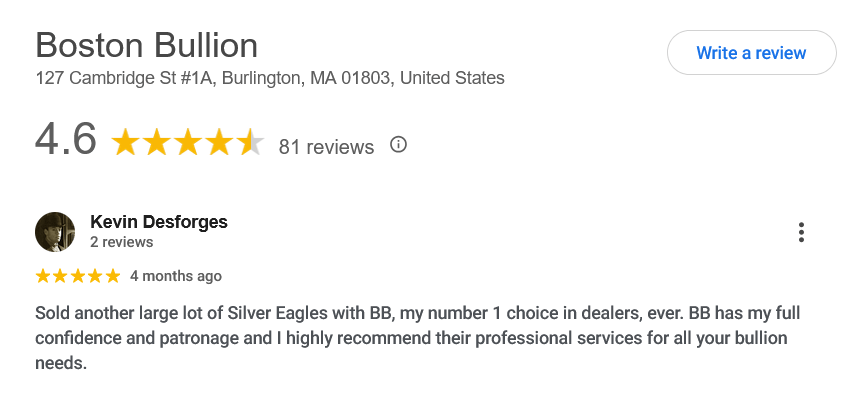

The review profile of Boston Bullion isn’t like that of most other companies we’ve encountered, in that profiles on consumer watchdog sites like Business Consumer Alliance and ConsumerAffairs are absent.

There are two main sites where you can hope to get Boston Bullion Reviews that will clue you in on whether the company is good: the Better Business Bureau and Yelp.

- On their BBB page, they’re accredited with an A+ and have a 5 out of 5 stars based on 2 reviews. Admittedly not a lot, but enough to give us some idea. They’ve also had the accreditation since 2008, which is a long time, and more than many competitors have been in business altogether

- Having Yelp as its other review site sort of speaks to the company’s brick-and-mortar feel. Again, not a lot of reviews with just 14 total, which gives them a rating of 4.8 out of 5 stars

- The company also has a 4.6 rating on Google based on 81 reviews

Most of the reviewers are indeed those who have visited the Boston Bullion physical store and bartered for some precious metals. They generally say that they’ve gotten a very good deal and that the store owner or employee they spoke to was nice and straightforward.

Boston Bullion Complaints

As of today, Boston Bullion has one complaint on the BBB page. Additionally, the only “negative” piece of feedback we’ve encountered is from a customer who left a 3-star review on Yelp, stating that they have a 14% markup on incremental gold coins and a 5% markup on silver bars, in addition to a commission.

The customer doesn’t suggest there were hidden fees, though, as is often the case with complaints of this nature, but merely that the overall premiums are high. A fair point, but not really something we’d say detracts from the company seriously.

If you are ready to take action, >>>>see our list of the top 7 precious metals IRA companies (cash sales also available).

What Is Boston Bullion?

Boston Bullion is what looks to be a pretty large online retailer that nonetheless retains some small business vibes. It’s run by one Kenneth Murphy, who opened the company back in 2008.

Boston Bullion is what looks to be a pretty large online retailer that nonetheless retains some small business vibes. It’s run by one Kenneth Murphy, who opened the company back in 2008.

He says he got into precious metals early on as he started investing and notes that, the more you learn about them, the more you want to own them. Probably true.

Speaking to the aforementioned vibe, the company’s primary email appears to be Murphy’s personal email on the website.

Any time you get to interact with a company owner when buying bullion is a major plus, and this appears to be the case here.

Boston Bullion Products

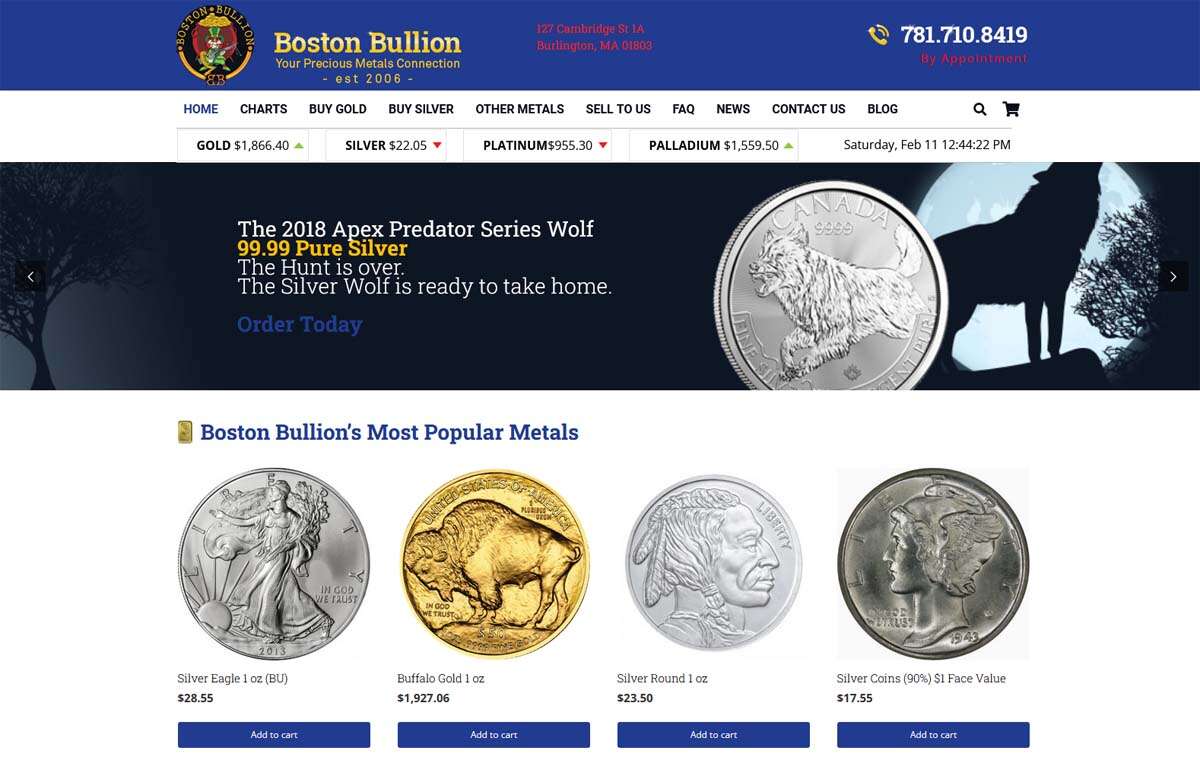

Being primarily a bullion dealer instead of a specialized precious metals IRA company, Boston Bullion can’t afford to have a shabby inventory, and it doesn’t.

The prices are listed and there are a lot of products, grouped under “gold”, “silver” and “other metals.” Even though the third category is much smaller, we’ll still give each of the metals their own section.

While the products are described in detail and the prices are there for the most part, some products don’t have prices. It’s less prominent in some sections and more in others.

Since numismatics all have prices up except one, this appears to be inventory depletion rather than a “Call for pricing” thing.

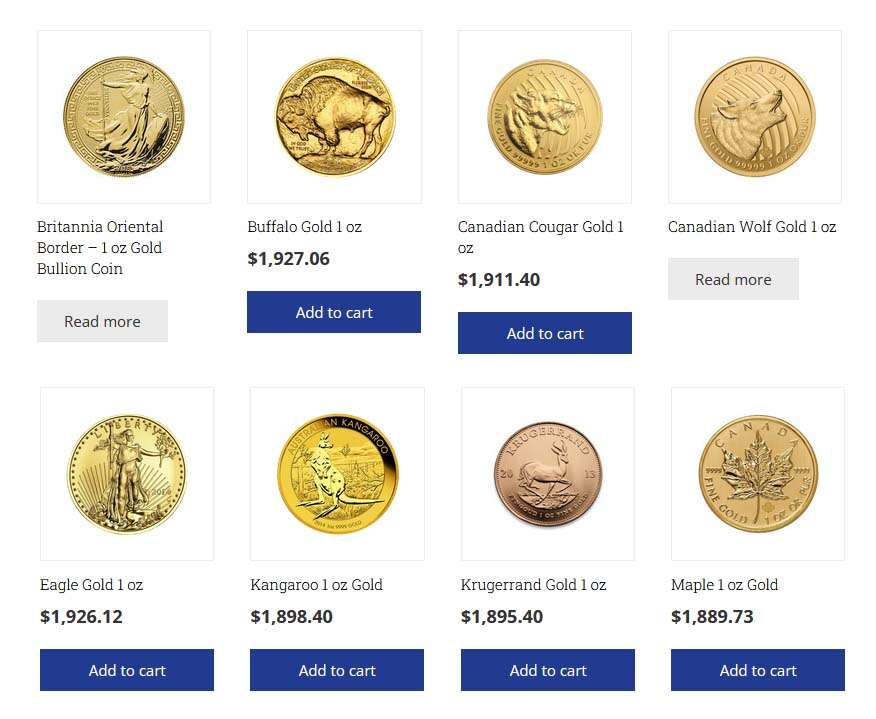

Gold

- American Gold Eagle, different denominations, seemingly only bullion

- Canadian Gold Maple Leaf, different denominations

- Australian Gold Kangaroo, different denominations

- American Buffalo, 1oz

- Austrian Philharmonic, different denominations

- Chinese Gold Panda, different dominations

- Canadian wildlife-themed coins, different denominations

- Mexican Onza, 1oz – a rarely seen contemporary gold coin

- Britannia Oriental Border gold coin, 1oz – another modern semi-rarity

- A lot of Lunar gold coins, some dating back decades

- A lot of the more common numismatic gold coins, insofar as these can be called common, to begin with

- Gold bars from various mints ranging in weight from 1 gram to 1 kilo

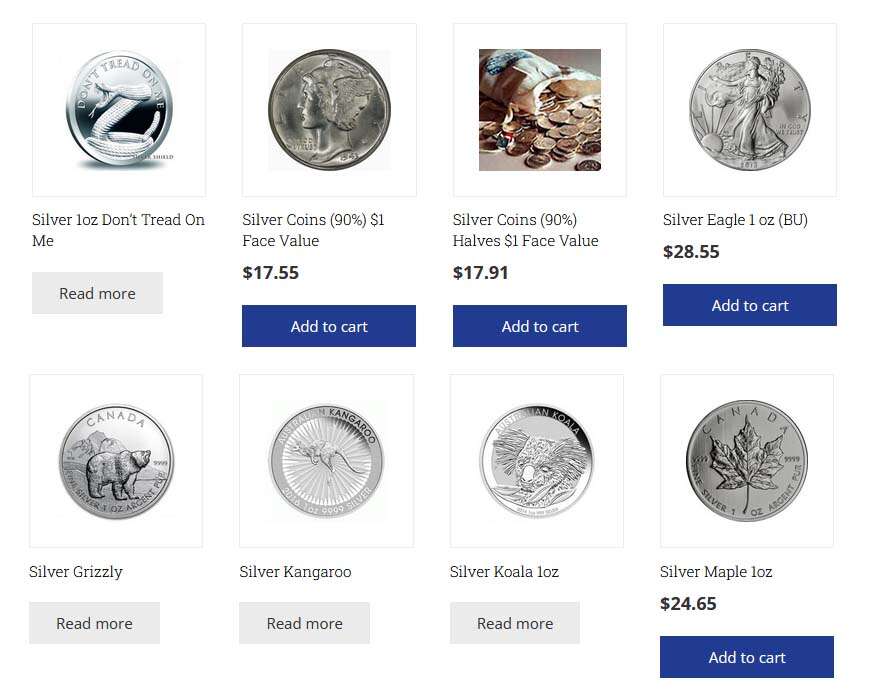

Silver

- American Silver Eagle, 1oz

- Canadian Silver Maple Leaf, 1oz

- Australian Kangaroo, 1oz

- Various Australian wildlife-themed coins, 1oz

- Chinese Silver Panda, 1oz

- Silver rounds from different mints, 1oz

- An inventory of 1-dollar and half-dollar “junk silver” coins

- Silver bars from various mints ranging from 1oz to 1,000oz

- Many different calibers of silver bullets in case van Helsing is preparing for a hunt

- A few silver nugget bars – these are basically to standard mint bars what rounds are to silver coins

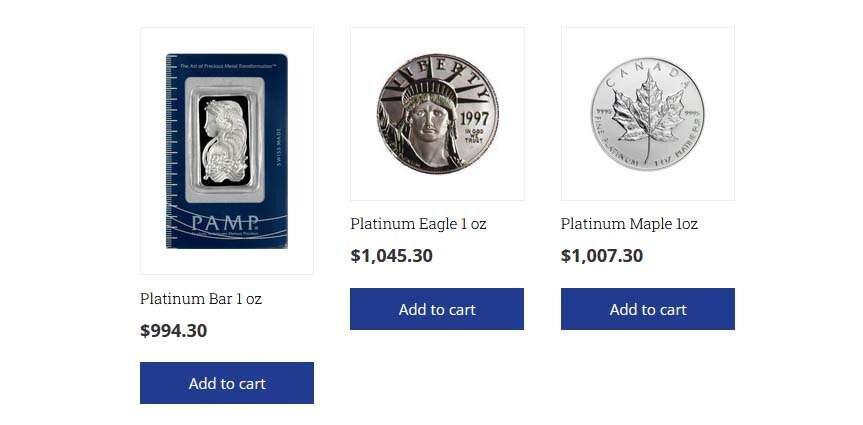

Platinum

- American Platinum Eagle, 1oz

- Canadian Platinum Maple Leaf, 1oz

- PAMP Suisse platinum bar, 1oz

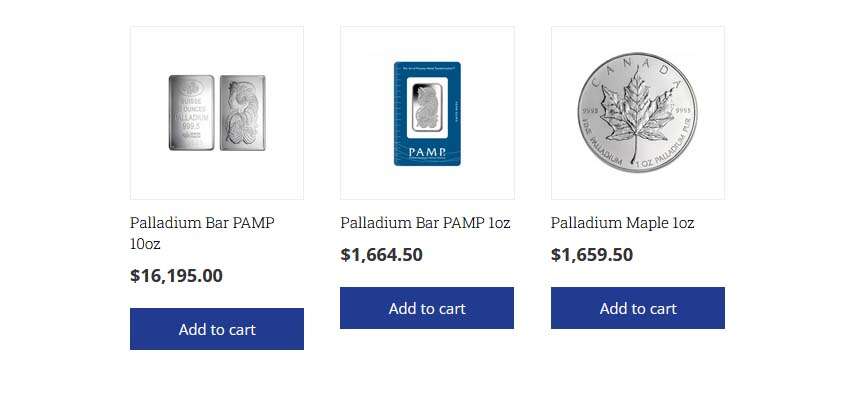

Palladium

- Canadian Palladium Maple Leaf, 1oz

- Pamp Suisse palladium bars, 1oz, and 10oz

If you are ready to take action, >>>>see our list of the top 7 precious metals IRA companies (cash sales also available).

How To Sell Your Precious Metals To Boston Bullion

The “Sell to us” section of the website is something that many companies of this kind should strive to have. It’s very well laid out, with specific instructions on how to sell, what is accepted, and what you can expect to get for it.

Boston Bullion buys metals in protective packaging they send to you, and the transaction is confirmed through a phone call. They pay within 1 to 5 business days, which is pretty fast, so long as they like what you’ve sent them.

Every single product they’re willing to buy is listed in detail, along with the exact markup they’ll take over spot. If the markup is true, and we have no reason to believe it isn’t, it’s highly competitive, generally being no larger than $30 or 2% on popular investment-grade bullion.

As always, the items you sell should be in mint condition. Any damage they’ve sustained will probably lower the price considerably, though Boston Bullion might still be willing to take them off your hands.

Boston Bullion Precious Metals IRA

Truth be told, we prefer not to see a large and reputable bullion dealer “try and dabble” in precious metals IRAs, but few can resist the temptation, and Boston Bullion isn’t among the resisting ones.

Their IRA offering is so occluded that you can’t be faulted for thinking it’s entirely absent: it’s practically hidden under a section called “How it works”, with no mentions of precious metals IRAs in general on the website.

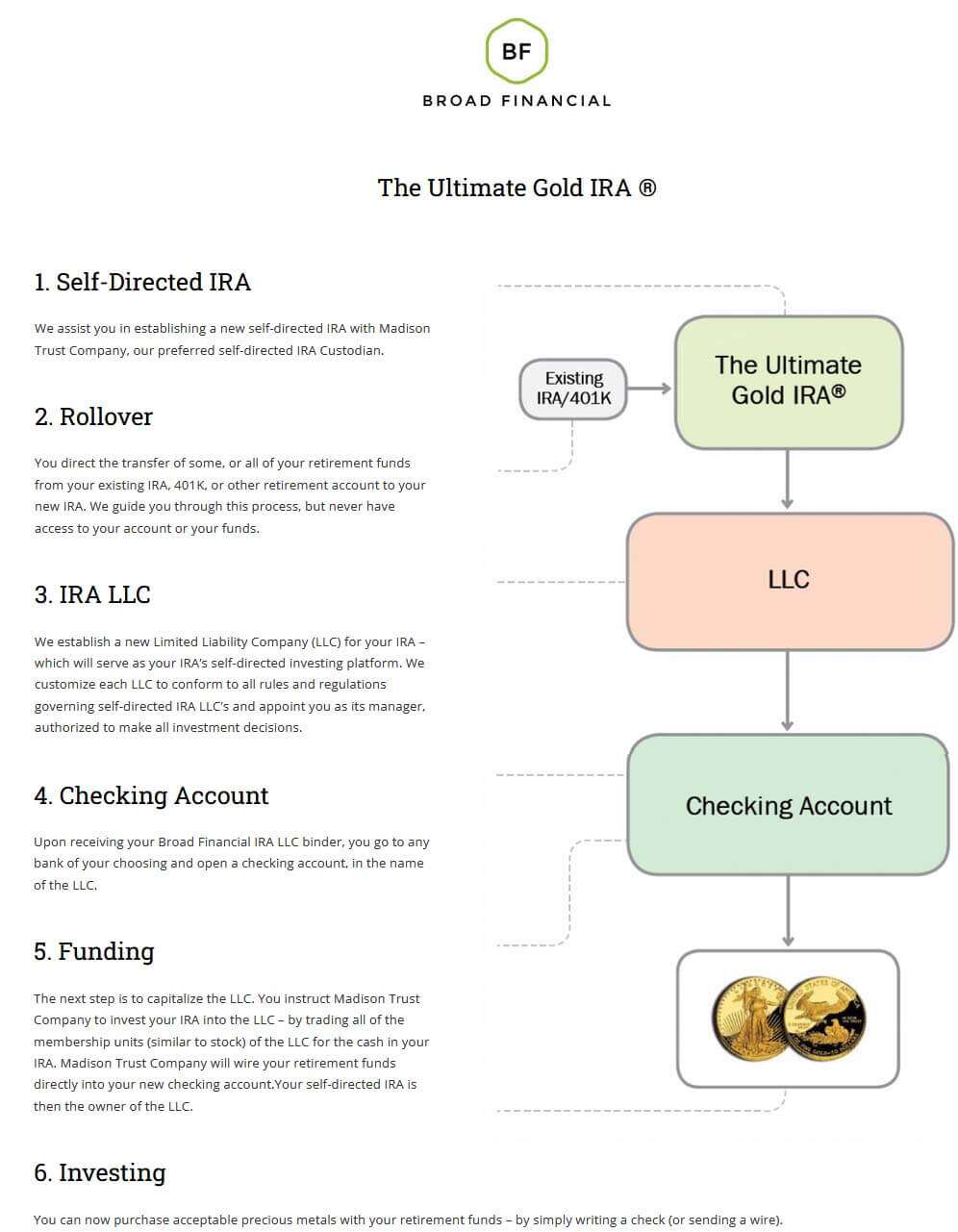

The process they outline on the site, though clear, is also somewhat odd. They appear to utilize two companies, one in the form of a preferred custodian called Madison Trust Company and another in the form of Broad Financial.

The Boston Bullion Precious Metals IRA requires you to open your own LLC, along with going to the bank to open a checking account, which isn’t optimal.

Is this a standard process? Not for the most reputable gold IRA companies in the industry.

In fact, most gold IRA companies claim a hands-off approach, with some being able to open your IRA in minutes. Just going by this, we’d say this is a non-standard way of opening a precious metals IRA, though it might be appealing to some.

For how hidden it is, the IRA section of the site is nonetheless fairly informational and covers some things you might not know about how these accounts work.

If you are ready to take action, >>>>see our list of the top 7 precious metals IRA companies (cash sales also available).

How To Fund Your Precious Metals IRA

Rollovers and transfers are generally preferred to deposits, and Boston Bullion makes no mention of the latter. To fund a precious metals IRA, you’ll want to have one or more employer-sponsored retirement plans or IRAs, preferably inactive ones.

These are liquidated through the custodian, and the funds from them are then used to purchase physical precious metals for your IRA. A straightforward process that every company we’ve seen in this sector adheres to.

Boston Bullion Fees And Transaction Minimums

Here’s a summary of Boston Bullion’s fees and transaction minimums:

- 3% commission on transactions under $50,000

- 2% commission on transactions between $50,000 and $150,000

- 1% commission on transactions above $150,000

- 1% commission when being paid through wire when selling the metals to them

- $20 shipping fee on orders of under $5,000, with free shipping on orders larger than that

- Not much is said about custodian and storage fees for the IRA, which generally don’t exceed $200 annually

- Likewise, no mention of investment minimums for the IRA opened through Boston Bullion

What About Storage?

We wonder, too. Boston Bullion tells you on the website that they don’t offer any kind of third-party storage solution because they believe gold and silver should be stored privately in a home safe. A fair point, but one that many customers might disagree with.

Since home storage isn’t allowed according to IRS regulations for IRAs, we’d assume that they offer some kind of storage in a depository through their custodian, but nothing is mentioned in terms of specifics. This is definitely something we’d like to expand on a bit more.

Brokerage Fees Vs Bullion Premiums

These are pretty easy to understand, and Boston Bullion’s website makes it all the more so. Precious metals dealers charge what is known as a premium over spot.

Put plainly, you can’t buy spot bullion from a good retailer: it’s always going to have a premium. This “physical metals” premium is the result of various things that aren’t an issue when trading paper gold, such as shipping, storage, and so on.

The commission fee is the additional fee that the company places on the transaction once it’s done. It might seem strange or a bad deal to have two fees applied to one purchase, but this is the industry standard.

Furthermore, Boston Bullion is very up-front about the fees, even listing how much you’ll be charged in terms of premium when selling any individual coin or bar.

So even though nobody likes paying extra for something they’ve bought, Boston Bullion handles this part well, which is probably why they’ve gotten as much good feedback as they have.

If you are ready to take action, >>>>see our list of the top 7 precious metals IRA companies (cash sales also available).

Pros And Cons Of Boston Bullion

To give you a quick recap, here are some pros and cons of Boston Bullion:

- Excellent selection of bullion with rare modern coins and contemporary collector’s pieces

- Good premiums, which are competitive and also listed clearly

- Great reviews

- A weird and unclear IRA offering

- Seemingly no proof coins of any kind, which is pretty strange for a bullion dealer

- Not much in the way of platinum and palladium

Verdict Boston Bullion Review: Is Boston Bullion a Scam?

It’s pretty clear that Boston Bullion doesn’t fall anywhere close to the category of scam. However, a few points should be made.

It’s pretty clear that Boston Bullion doesn’t fall anywhere close to the category of scam. However, a few points should be made.

As with any specialized bullion dealer that branches off into IRAs, it’s clear that acting as a retailer is still their day-to-day, while IRAs are a kind of additional service, almost as to not dissatisfy customers with a total lack of offering.

We believe in opening precious metals IRAs through companies that are truly specialized because the service you get simply isn’t comparable. You’re assigned a representative who guides you both through the initial opening and the later management of your account.

You can get detailed information pertaining to precious metals IRAs whenever. And you get the feeling you’re working with experts in general.

This is really the only critique of Boston Bullion we have. If you aren’t looking to open a gold IRA but would simply like to purchase quality bullion or even sell it for a good price, Boston Bullion is a good choice.

You can either make use of their physical store or facilitate a purchase or sale through the website. The selection of bullion is great, with not only rare coins and collectibles but also some of the more unusual products made from precious metals available for purchase.

Both the premiums and the commissions are transparent and among the lower ones you’re likely to find with any retailer. If you like something in their online store, we see no reason not to go for it.

If you are ready to take action, >>>>see our list of the top 7 precious metals IRA companies (cash sales also available).

Boston Bullion Alternatives

If you want to look around a bit more before making a final decision on what gold IRA provider to choose, we have reviewed and rated the best gold IRA companies for 2026. You can request their gold IRA kits directly from the reviews table below:

>

Or, you can get a free gold and silver investment kit from our #1 recommended precious metals investment company.

Or, you can see if you qualify for their ===> unlimited FREE silver promotion.

If not, you can go directly to Boston Bullion’s website.