·

+1-855-222-6993

·

[email protected]We are reader-supported. If you buy through links on our site, we may earn a commission. Learn more.

- Home

- About

- How To Invest In Gold

- Best Gold IRA Companies

- Crypto IRAs

- Blog

Thank you for visiting our BullionVault review for 2026. In this in-depth review, we have looked into the company’s gold and silver trading, customer reviews & ratings, products, fees, investment minimums, and much more to see whether BullionVault is worthy of its reputation as a worldwide online trading platform.

Our goal is to provide you with the most accurate and reliable information to help you identify the best option to grow and protect your wealth today.

With careful and extensive research, we have reviewed and rated the 7 best precious metals IRA companies for 2026 to help make your decision easier!

>>See our list of the top 7 precious metals IRA companies (cash sales also available).

Since this is a comprehensive review, feel free to use the quick links in the TOC list to jump straight to any section:

| BullionVault Galmarley Ltd T/A 3 Shortlands (7th Floor) Hammersmith P London W6 8DA United Kingdom |

Products Available:

|

| BullionVault is an award-winning gold and silver trading company, which enables individuals to buy and sell physical gold, silver, and platinum. In 2013, the Company won the Queen’s Award in the category of international trade. |

BullionVault is the biggest online gold and silver trading company in the world. Individuals and professional investors have the option to buy vaulted gold on a regular basis, similar to a savings plan, as well as roll over or transfer physical metals to a Self-Directed Individual Retirement Account – a so-called Gold or Silver IRA.

Investors can trade gold, silver, and platinum bullion, which is stored on their behalf by an independent vault operator. As a result, they acquire outright ownership of their precious metals holdings and have a delivery option.

In this BullionVault review, you will learn:

We have looked into all of this so that you can make the best choice for your future investments.

But before we dig deeper into our BullionVault review for 2026, let us first present our complete gold investing guide, and why it can be good to check it out before you make your first precious metals investment.

If you are new to investing in gold and silver, or you are researching the cheapest way of holding metals, you will find the information you need in our gold investing guide.

If you are new to investing in gold and silver, or you are researching the cheapest way of holding metals, you will find the information you need in our gold investing guide.

The guide walks you through the different ways you can buy precious metals, what metals are best to invest in, and lists reputable precious metals companies to buy from.

Our goal is to give you solid facts and figures to keep you well-informed of all the specific information that is pertinent to this type of investment so that you can decide if it is for you.

In addition, the guide also walks you through how to store your bullion and other facts that will be useful to know before you make your investment.

The bottom line is that if you are looking for a tried and true investment that can provide stability to your portfolio, you should invest in physical gold bullion.

With that being said, let us present to you our unbiased in-depth review of the world’s largest online gold dealer, BullionVault, and the process of gold and silver trading, as well as their products, fees, the cost calculator, and much more.

How To Start Buying Gold From BullionVault |

To begin, founded in 2005 by Paul Tustain, BullionVault is now partly owned by Galmarley Ltd and Augmentum Fintech plc.

It holds gold in vaults in London, Zurich, New York, Toronto, and Singapore for its customers. And as early as June 2012, BullionVault held around 30 tons of gold. The company is registered in England and is regulated under UK Company Law.

Because it trades in bullion, which is outside the scope of the Financial Services Authority (FSA), it is not regulated by it. It is, therefore, not reviewed by the BBB (Better Business Bureau) either.

Let alone, BullionVault provides individuals and professional investors around the world with access to professional bullion markets. With BullionVault, you can benefit from the lowest costs of buying, selling, and storing gold and silver bars.

It is known as the world’s largest online investment gold service, and services 3 billion dollars for at least 90,000 customers. You can say that BullionVault is a peer-to-peer silver and gold exchange.

More specifically, it functions like a stock brokerage in the sense that members can buy and sell, as well as easily store and keep track of their investments.

Additionally, BullionVault was twice the winner of the Queen’s Award for Enterprise in the United Kingdom.

In 2009, they won the Innovation Award for enabling private investors to access the professional gold bullion market. And in 2013, they won the Queen’s Award in the category of international trade.

One thing that makes Bullionvault stand out is the fact that it is partially owned by the World Gold Council. This allows customers to have direct access to the professional bullion market. And BullionVault has also been a member of the London Bullion Market Association since 2008.

A purchase of gold through BullionVault is an investment into bullion bars or coins. And the bullion is stored in professional-market vaults in Zurich, London, Toronto, Singapore, or New York.

Besides, BullionVault can also deliver gold coins, but only to UK residential addresses. The gold bars are of investment-grade gold and are available in a range of sizes from 1 gram or 1 ounce.

Best of all, investors have access to their accounts and can buy and sell gold through BullionVault, 24 hours a day, every day of the year. This makes it a great offering for active gold investors, as well as those with a buy-and-hold profile.

For this reason, BullionVault’s accounts are audited daily, with lists of client holdings matched against its actual holdings. This is done by a nickname system, and only account holders know their nicknames. An investor can ‘see’ his gold by viewing the independently posted audit.

Next, let us move on to who BullionVault is best for.

Think back to the 2008 Great Recession. It was a devastating time for millions of investors, and many people lost it all. Now, with the aftermath of the pandemic, we are in the middle of another financial crisis with persistent high inflation and a possible recession lurking around the corner. Needless to say, the effects on the economy are expected to be long-lasting.

Gold serves as financial insurance and protects your savings account from the effects of stock market volatility and inflation. In fact, investors who own physical gold and silver have financial insurance that will appreciate in value when the fiat system depreciates.

To summarize, precious metals will help you:

Just a small allocation of precious metals–5% to 10%–could add a significant amount of protection to your portfolio if things get ugly in the financial markets.

Now, let us take a look at one of the most important aspects of this in-depth BullionVault review for 2026: their products.

|

An investment through BullionVault is a purchase of physical gold, silver, or platinum that is held in an allocated account within its safe and secure vaults. You can own any quantity of physical bullion in about 2 hours. This is beneficial for investors since they do not have to pay the costs of taking delivery of the metals. Besides, gold and silver prices and the cost of storage is incurred at wholesale rates rather than the more expensive retail rates. When you buy metals outright, you can either keep them in one of BullionVault’s secure vaults or have them delivered to your home. Better yet, you can sell at any time, without penalty, and your money will be wired the next business day. Note that if you choose to take home delivery of your metals, you are often charged VAT, shipping, and insurance costs. Moreover, the silver market only deals with you purchasing large bars that meet Good Delivery Specifications of the London Bullion Market Association. All silver that is purchased through BullionVault is held in 1,000 troy ounces and is stored in market-approved vaults. Importantly, the gold and silver are certified as investment grade and is held in a named and numbered account for the benefit of the purchaser. |

|

If you would like to open a Self-Directed Gold IRA (Individual Retirement Account), you can invest in gold, silver, or platinum for your retirement. A gold IRA permits individuals to diversify any portion of their retirement portfolio — including pre-existing IRAs and former 401k(s) with previous employers — by actually owning physical gold and other metals within that retirement plan. Investors can securely possess physical precious metals in a tax-deferred account. You can find more details on how to get started in the gold IRA opening process. |

|

Like a gold IRA, you can choose to include silver in an Individual Retirement Account. Better yet, you can include all metals: silver, gold, and platinum in your IRA, no matter gold or silver IRA. When investing in precious metals through a retirement plan, you actually invest in physical silver bars. It is an investment you can hold that will not disappear if the paper currency does. And at age 59½, you or the beneficiary of your gold or silver IRA can start taking penalty-free distributions from the account, according to the IRS. |

|

An Automatic Gold Investment Plan offers automatic investments in gold. Once set up, investors can simply deposit money into their BullionVault accounts, and the money will be used to purchase gold automatically. Investors do not need to place any orders or trade directly on BullionVault’s trading platform. An investor can set up a monthly automatic payment or standing order from his bank account to make regular deposits (e.g., every month) to his BullionVault account for the purchase of gold. The Automatic Gold Investment Plan differs from traditional savings plans in that investors are completely free to decide when and in what amount they make deposits into their accounts. In addition, they can adjust the frequency or amounts of their payments and stop making deposits at any time without any negative consequences. You can find more details about BullionVault’s Automatic Gold Investment Plan on BullionVault’s website. With that said, be advised that BullionVault charges a commission fee to purchase and sell bullion. There is also a monthly fee to store your investment (insurance is included in the storage cost). |

There are requirements and guidelines you must follow according to the IRS when investing in a precious metals IRA.

Here are the IRS requirements:

With this in mind, at BullionVault, all gold, silver, and platinum are equal to the purity standards set by the IRS. Moreover, all bullion is stored in your choice of professionally operated vaults.

There are best practices when it comes to opening a gold or silver IRA at BullionVault. Here you can read about the 4 steps:

|

1. Select Your IRA custodianThe first step is to find an IRA custodian or administrator who is able to hold gold, silver, and platinum in an IRA. BullionVault uses New Direction Trust Company and MidAtlantic IRA, LLC as their custodians. If you do not want to use any of BullionVault’s options, it is recommended that you make sure whoever you choose as your administrator meets all your needs and follows all the requirements set by the IRS. |

|

2. Open An IRA AccountThe next step is to open an IRA account with the administrator you have selected and fund it through a transfer, rollover, or an IRA contribution. |

|

3. Select Your Precious MetalsBe sure to tell your administrator that you want to buy IRA bullion from BullionVault by completing the form for Buy direction or a Purchase Authorization Letter. For more details, you can contact an IRA expert at BullionVault. |

|

4. Purchase Precious MetalsAfter the account has been funded, your purchase of gold, silver, and platinum will be sent to the account. As simple as that! |

With BullionVault, you can buy gold and silver at the cheapest prices in the market. For starters, you can buy gold in 1-gram or 1-ounce increments within LBMA-approved wholesale bars. And you also have the option to invest in gold or silver coins.

The Company guarantees gold and silver prices closer to the wholesale market price. They are able to have such competitive prices since they purchase their metals in bulk and can pass much of these savings to their customers.

The BullionVault gold chart displays the daily gold spot price. You can always trust BullionVaults’ gold chart to show you the most recent daily gold spot price.

The gold chart also shows you the price of both buying and selling gold per troy ounce:

Next, let us move on to the rates and costs of trading gold and silver.

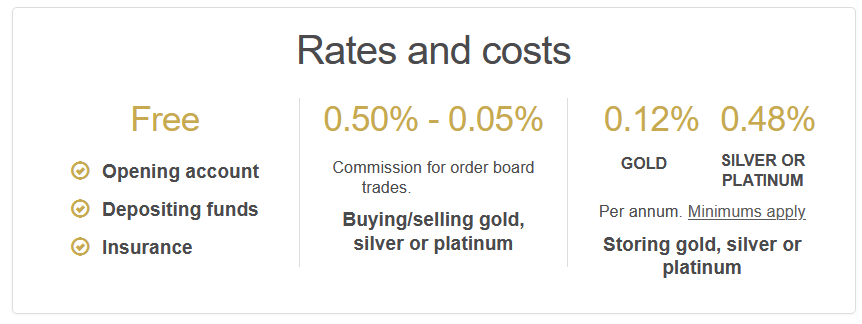

The BullionVault fees and commissions are as follows.

Premium/mark-up for buying and selling gold:

Commission for buying and selling gold (commission applies both for the purchase and sale of gold):

All commission tiers are calculated annually. And the commission rates will reset to 0.5% on the anniversary of the client’s account registration each year.

Costs for storage and insurance:

Withdrawal fee for delivery of gold:

Withdrawal fees for funds:

Automatic Gold Investment Plan fees:

What is more, an investment can be made in either Euro, Sterling, or US dollars. This means that the potentially costly exercise of exchanging currencies can be avoided.

The next topic we want to clear out in this Bullionvault review is that of investment minimums.

There is no minimum trade size (except that the increment is in whole grams or ounces). When buying or selling at the daily gold spot price, you pay a flat commission of 0.5%.

However, there is an additional 0.3% currency-switching fee for daily gold spot price orders set in British Pounds, in Euros, or in Japanese Yen.

As a result, rates are the same when you sell, and you can trade in US Dollars, British Pounds, Euros, or Japanese Yen. And the average spread (the difference between the buying and selling price) is zero.

Now to something important if you are wondering whether to invest in BullionVault bullion or not, what do customers say about BullionVault?

Needless to say, due diligence is important before investing money into anything, whether it is stocks, bonds, gold, or silver. Investors may wonder how to figure out if they are working with a legitimate gold or precious metals dealer.

Fortunately, the World Wide Web makes it difficult for companies to hide. Customers can go online and vent any frustrations they may have with their gold dealer.

As you can see below, BullionVault remains a greatly respected company in its industry, at the same level as its highly regarded rivals and foremost among the sector’s leading competitors:

Reviews & Ratings |

|||||

|

What brings the overall review rating down a bit is either frustration over the fact that the bank deposit is taking longer than expected, or that the account validation process is a bit complicated for some people.

However, we found it to be pretty straightforward, but not all people are used to uploading documents online.

Now that we have looked into the customer ratings, we will move on to one of BullionVault’s strongest features, the cost calculator.

One of BullionVault’s strongest features is the cost calculator. It allows you to calculate the costs of commission and storage fees easily and efficiently so that you know what your gold or silver investment will cost you.

It is a transparent functionality that removes any question marks you may have.

Note: You should take into consideration that the trading commissions decrease the more you trade.

You can find a direct link to the cost calculator at the bottom of the website.

Now, let us move on to new customer specials.

BullionVault offers 4 free grams of silver when starting an account.

The offer is risk-free and is meant to give you a taste of BullionVault’s unique order board.

Whether you choose to store in one vault or spread your holdings across more, you will get the cheapest storage rates in the world: only 0.01% per month for gold ($4 min.) or 0.04% per month for silver or platinum ($8 min.), including insurance.

As a result, you can rest assured that your metals are stored in extremely safe professional-market vaults in Zurich, London, Toronto, Singapore, or New York. Whatever you prefer.

We hope this answers your questions about storage. Next, let us present our list of the pros and cons of BullionVault.

To give you a quick recap, here are some pros and cons of BullionVault:

|

|

By now, you are probably wondering how to open a BullionVault account, and that is exactly what we will show you next.

To open an account at BullionVault is an easy online process, which takes around 2 minutes.

There are details to supply in the registration stage, and then the account needs to be funded (either by bank transfer or card payment).

All customers will have to validate their accounts within 2 weeks of registration. This is a legal requirement, though again can be done online and only takes a few minutes.

In addition, an investor may need to provide extra details or documentation for money laundering purposes.

Once the funds have been transferred into the investor’s BullionVault account, deals to buy and sell gold can be executed via its online trading screen.

With a single click, you can buy gold and silver bars.

Customers can also post bids and offer on the trading system, allowing them to trade ‘the right side of the spread’, almost unique in the market.

Here is a breakdown of the 4 simple steps to open a BullionVault account:

This is what the registration form looks like:

BullionVault has associates ready to answer any questions you may have or help you with account-related issues. The Company’s normal business hours are:

| Monday to Friday: | 9:00 am to 8:30 pm (U.K.) |

If you need any assistance, you can call BullionVault at +44 (0)20 8600 0130 or 1-888-908-2858 (U.S. and Canada toll-free) or send an email to [email protected].

Our verdict of this Bullionvalut review is that the company is legit, and in fact, the best and largest online bullion dealer and trading platform in the world.

First of all, the company is taking care of $3 billion for more than 90,000 users, which adds credibility and trust to the equation. Also, you can always buy and trade (or hold) BullionVault’s gold, silver, and platinum for the lowest prices in the market. And you can trust that your investment is safely stored in secure vaults in Zurich, London, Toronto, Singapore, or New York.

More importantly, the fact that BullionVault is an online worldwide precious metals dealer makes it accessible to everyone. Individuals can easily invest in gold, silver, and platinum through BullionVault. Best of all, they can buy metals using several international currencies in order to get the most affordable gold and silver prices.

Even though BullionVault is an online gold and silver trading company, they always have experts ready to help you out if you have questions about your investment or how to open an account.

To recap our BullionVault review, we want to highlight the fact that the Company has excellent customer reviews and is seen as a trusted and respected online gold dealer that has served its customers since 2005.

Besides, BullionVault is partially owned by the World Gold Council. And as a result, customers have direct access to the professional bullion market.

We would say that BullionVault is the ideal precious metals dealer for individuals, as well as professional gold and silver traders. The company offers the absolute lowest costs for buying, selling, and storing gold and silver.

Haven’t opened an account yet?

What are you waiting for? Click here to start a BullionVault account!

Follow the money! Billionaires have a lot of it, and you shouldn’t lose out!

If you want to look around a bit more before making a final decision on what precious metals company to choose, we have reviewed and rated the best gold IRA companies for 2026 (cash sales also available).

To learn more about the benefits of investing in a Goldco gold IRA and how to get started, please request the FREE Gold IRA Guide, or find more information here.