Another year, another crypto downturn and another posing of the familiar question: is crypto dead? We heard it in 2018… and pretty much every subsequent year.

Now, it’s time to delve into it in more detail.

We’ll go over what a dead market looks like, why crypto is being called dead, and whether or not you should feel comfortable investing in crypto.

Let’s begin…

What Is A Dead Market?

That’s an easy one, isn’t it? For a financial market to be dead, it would have to have no activity. Try and think of the most ridiculous thing people are transacting in. Funko Pops? Let’s go with that. People are buying and trading Funko Pops, so that market isn’t dead.

It’s very much alive.

In order for a market to be dead, there would have to be less than two people engaging in it. So right from the start, crypto can’t and has never suited the definition of a dead market. The trading volume is actually increasing even during bear stretches.

That means… you guessed it: even as people wonder whether crypto is dead, the market is becoming more alive.

It’s not just trading activity that’s increasing. Even during times of near recession or recession, such as the one we are in right now, crypto is still finding ways to expand. New projects are being started, whether it means coins, exchanges, NFTs, websites, and so on.

Although we’ve seemingly answered the question, it pays to go in-depth a little more. After all, crypto has always been surrounded by bear sentiment, perhaps more so than any other market. So it’s a question we’re likely to keep hearing cycle after cycle.

Why Do Many People Think Crashes Equal A Dead Market?

Novelty is undoubtedly the culprit here. Whether you invested in crypto in 2014, or in 2017, or last year, the same doubts seem to linger:

- Is this going to be totally wiped out?

- Is there any future to this investment?

- Is it really just a fad?

And so on. It’s obvious that this is because crypto is just a little over a decade old. It’s being compared to bonds, stocks, gold, and the like. These markets have existed for centuries. Imagining them dying out is difficult, though becoming a little more plausible in the case of paper assets as the global economy shakes.

But more on that later.

With crypto, there is basically no precedent. There is no reason to assume the market will perish or have its value wiped out, but the doubt is there. It doesn’t help that its market cap oscillates between $1 to $2 trillion, which is not a lot of money for some. Small market, easier to envision its demise.

If you are ready to take action, >>>>check out our #1 recommendation of digital assets company.

Or, request a >>>>FREE Guide on Digital IRAs right away.

2017-2018: The Make-Or-Break Turn

No amount of convincing is going to get us to change our minds in regard to this. If crypto was going “back to zero,” as some say, it was going to happen around the start of 2018. It skyrocketed in value in roughly 6 months, starting in the summer of 2017 to reach the infamous $19,000 peak for a Bitcoin token.

No amount of convincing is going to get us to change our minds in regard to this. If crypto was going “back to zero,” as some say, it was going to happen around the start of 2018. It skyrocketed in value in roughly 6 months, starting in the summer of 2017 to reach the infamous $19,000 peak for a Bitcoin token.

Then came the plummet. By the time BTC deflated to $3,000, things were indeed looking sour. There wasn’t much in terms of infrastructure, although it was being built, buried under more bombastic headlines.

The proponents appeared to be mostly true believers. And there were a whole lot of names in finance saying that it’s going to get wiped out.

As we all know, it rose steadily since then pretty much in the same fashion as it did heading up to the summer of 2017. Then Bitcoin reached $68,000 a piece. Now, we are actually above $19,000, the highest point in 2017 that had everyone screaming mania.

What does that tell us?

First of all, it seems like there’s a lot more upside to crypto than we dare to believe. We aren’t talking about the 1970s or anything here, where the pricing can be attributed to inflation.

In just five years, the peakest of peaks became a bottom that many would rather not speak of. What does that say about the next peak and the next bottom?

Understanding Market Cycles

Because so many crypto investors started with crypto and have little or no experience with other markets, they don’t really understand the concept of market cycles.

This is probably the other main cause of consistent doom predictions, though we’ll mention a few more. Other factors aside, markets generally move in a cyclical, almost predictable fashion:

- Bull cycles, characterized by price gains across the market, followed by…

- Bear cycles, characterized by broad losses regardless of an asset’s independent standing, followed by…

- Bull cycles, characterized by… well, you get it

Take any market dating back however long, and you’re going to find this to be a basic truth. We hear terms such as “housing bubble” or “stock market bubble”, but when these bubbles burst, the markets don’t disappear.

The assets just lose in value, only to gain later on. That’s where the likewise basic investment advice of “buy low, sell high” comes from. The trick is, of course, handling the stress involved.

But how long do cycles last?

Though runs should be confined to less than a decade, the stock market’s most recent bull run is already lengthier than that. That’s why there are not only increasing cautions about a stock market crash but worries over how bad the next crash is going to be. Hot summer, cold winter, and all.

How Prominent People Can Affect Crypto Demand And Markets

The crypto market is also steered by prominent names like Elon Musk and the statements he makes about crypto.

For example, the Shibu Inu-branded cryptocurrency is up more than 35% since Monday October 24 because Elon Musk floated the idea that Dogecoin could be used as a payment method for Twitter’s upcoming subscription service when he takes over.

That’s pretty much all it takes to get people to buy more Shibu Inu than ever.

If you are ready to take action, >>>>check out our #1 recommendation of digital assets company.

Or, request a >>>>FREE Guide on Digital IRAs right away.

The Future Of Finance

Crypto is variably called the future of finance and the future of money. The more one looks into the market, the more one understands this to be the case.

For one, it’s a true permissionless system of finance: we no longer need nor want an intermediary, be it a bank or a government, to facilitate our transactions. We can send it straight to the person, providing they’re “crypto literate”.

And if there was no use case for crypto or no particular reason why anyone should invest in it, we might understand why so many are quick to jump the gun during every downturn.

But the use case has always been there. Everything everywhere is monopolized and centrally controlled by a few large entities that tell us how, when, and to whom. Finance is no exception. An asset class that is looking to change this is obviously one to keep an eye out for.

Digital finance is fairly new, and if we look back to how it’s been handled in the few decades it’s been around, we are left wanting. Banks and governments have most of the say and all of the control. There is practically no privacy to any transaction, and with privacy goes liberty, too.

Since cryptocurrencies are a form of invention that is trying to change this for the better, and the first such invention since digital finance, wondering if crypto is dead is a bit strange.

What would take its place? Are we going back to banks, be they private or central ones? Most people who are into crypto aren’t big fans of that idea.

If you are ready to take action, >>>>check out our #1 recommendation of digital assets company.

Or, request a >>>>FREE Guide on Digital IRAs right away.

Governments: Crypto’s Biggest Enemy?

Regulation is a buzzword for all the wrong reasons in the crypto market. Crypto investors constantly fear regulation. And, in fairness, there are some prominent names saying governments will clamp down on them.

But weren’t there also prominent names saying cryptocurrencies will die out in 2018?

The most prevalent concern, or perhaps fear, right now among crypto users is some kind of broad “regulation.” China, being what it is, is trying and failing to outright ban crypto. This is what Western investors are worrying about.

Another reason why governments, which are referred to as regulators, aren’t too keen on crypto is that it is private competition for something they’re issuing: money.

Whether one talks Bitcoin or a token issued by a company, it’s an independent currency competing with the government’s own currency. There are even digital versions of the dollar, such as Tether, that will presumably remain in competition if the Federal Reserve issues its CBDC.

Of course, crypto was meant to combat various malpractices on behalf of governments, and regulation and censorship are among them. As China can attest, and Russia for that matter, crypto isn’t easily shut down.

Many wonder how possible it is in the first place. That’s why most governments have, so far, assumed a kind of “let’s play along and make money off of it” attitude. Not unlike the case of alcohol.

Does that mean cryptocurrencies will be as well-defined or ill-defined and regulated as alcohol? These are some pretty futuristic predictions that we don’t really need to get into just yet.

Who’s Betting On Crypto To Persist?

Who are the largest crypto investors? Privacy enthusiasts? Digital currency fans?

Nope. It’s institutional money. People with a lot of investment expertise are buying crypto by the fistful, so they probably see it as a worthwhile asset.

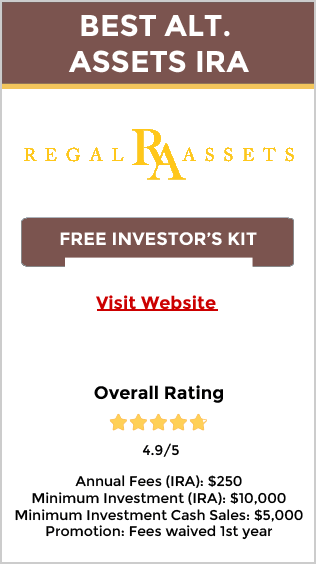

Another noteworthy thing is that companies specializing in retirement assets have taken an interest in crypto. BitIRA and Regal Assets are two companies that let you open a digital IRA and purchase various tokens in it, and even trade them within the account.

If you’ve heard of self-directed IRAs, you probably know that gold is one of the most popular investments to advertise for these accounts.

Why? Because gold is perhaps the most stable and time-proven asset, but also one that pretty much guarantees gains if you hold onto it for a while. Would reputable retirement investors companies get into cryptocurrencies and offer them to retirees if they expected a rug pull?

Hardly. Not coincidentally, precious metals are the other major thing that these two companies offer.

Both BitIRA and Regal Assets are excellent options for you to obtain exposure to cryptocurrencies with some unique benefits that you can’t get through other investment vehicles.

Unlike exchanges, these companies treat their customers individually and view an account opened with them as a long-term partnership. Besides a good token selection where most tokens of dubious value have been vetted out, you’ll also have the benefit of the kind of customer support and even advice that most crypto investors can only dream of.

And in a turbulent market, that can anchor you and give you peace of mind when you need it most.

Before you go, request a >>>>FREE Guide on Digital IRAs and learn more about adding crypto to your retirement account.

Not only do we provide a

Not only do we provide a