Read on to find out what you need to do to protect and grow your savings and escape living paycheck to paycheck.

Let’s begin by taking a look at the current situation.

Alarming News – 67% Of Adults Live Paycheck To Paycheck

According to a recent study, approximately 67% of adults in the United States are living paycheck to paycheck, largely attributed to the effects of inflation. The Paycheck-to-Paycheck Report by PYMNTS’ revealed that as of December 2022, around 166 million American adults reported having no money remaining at the end of each month.

This represents an increase of 9.3 million individuals compared to the previous year, including approximately 8 million high-income earners. Interestingly, the research highlights that even over half of those earning above $100,000 were also experiencing the challenge of living paycheck to paycheck in December.

The financial squeeze faced by individuals is backed by statistics. According to LendingClub, as of February 2023, 60% of adults were living paycheck to paycheck, even though inflation rates had dropped from the previous year.

What Are The Main Causes Of This Situation?

So what are the main causes of this situation? One significant factor is spending habits. About 21% of those living paycheck to paycheck attribute their circumstances to nonessential spending. Additionally, the report indicates that 36% of Generation Z respondents consider their spending in at least three categories as “indulgent.”

When examining income brackets, the largest increase in the number of people living paycheck to paycheck was observed among those earning less than $50,000 annually, rising from 74% in July 2022 to 78% in July 2023. Among those earning between $50,000 and $100,000, there was a 2% increase, reaching 65%. Conversely, among those earning over $100,000, 43% now find themselves living paycheck to paycheck, representing a modest 1% increase from the previous year.

These findings are in line with a January report showing that 57% of Americans would face difficulty affording a $1,000 emergency, as well as a Federal Reserve survey revealing that nearly 4 in 10 Americans wouldn’t be able to cover a $400 emergency expense.

How To Combat Living Paycheck To Paycheck & Grow Your Savings?

All in all, investing and diversifying are key strategies for optimizing your financial growth. By investing your money, you increase the likelihood of it outpacing inflation and experiencing substantial gains over time.

Diversify your savings portfolio with alternative assets that stand outside of the financial system like gold, silver, and crypto. These assets have historically moved opposite to the dollar and are a proven hedge.

Consider this…As long as the Fed keeps printing more money, the dollar will be worth less and less and will take your savings with you.

Additionally, a recent survey conducted by the World Gold Council revealed that 24% of central banks are planning to increase their gold reserves in the coming year. This growing trend reflects a rising skepticism about the reliability of the U.S. dollar as a reserve asset.

It’s time to diversify your savings portfolio and create your inflation hedge now!

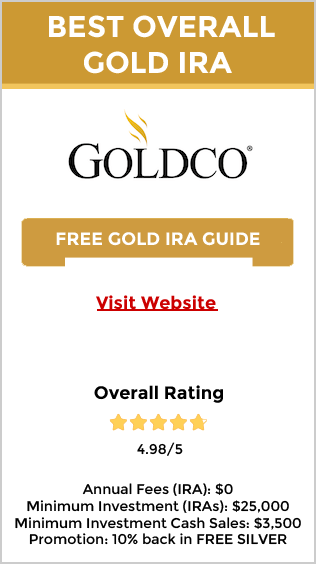

Here are our recommendations for the best precious metals and cryptocurrency companies in the industry:

Note: No matter what assets you choose to invest in, you should always consult with your financial advisor.