Gold Price Today: Live Gold Price Chart

30 Year Gold Price History

Top 7 Precious Metals Companies

All the precious metals companies below offer both regular cash purchases and precious metals IRA investments. Click on the Free Gold Kit Button to the right to learn more about each company.

>

Popular Gold Coins

Gold American Eagle

The American Gold Eagle is an official and authorized gold coin of the United States, which makes it one of the most popular gold coins to invest in.

Because the term “eagle” is the official United States designation for pre-1933 ten-dollar gold coins, the weight of the bullion coin is typically used when describing American Gold Eagles (e.g., “1/2-ounce American Gold Eagles”) to avoid confusion.

This is particularly true with the 1/4-oz American Gold Eagle, which has a marked face value of ten dollars.

This coin features an image of Lady Liberty holding an olive branch and a torch in a classic design by Augustus Saint-Gaudens. The name of the coin, however, comes from the design by Miley Busiek on the reverse side, which features a male bald eagle guarding his family.

Overall, the Gold American Eagle delights in unequaled acknowledgment and ease of liquidity, making it one of the best gold coins to invest in.

American Gold Buffalo

American Gold Buffalo is a gorgeous gold coin delight in remarkable appeal, mostly since their artwork is a performance of the famous 1913 Buffalo Nickel, by James Earle Fraser.

The American Buffalo gold coin obverse features the magnificent profile portrait of a Native American chief. It reversely portrays a marvelous American buffalo influenced by Black Diamond, the American bison that resided in New York City’s Central Park Zoo in the 1910s.

Investors are mainly choosing to invest in this gold coin due to its .9999 fineness and immediate recognizability.

Canadian Maple Leaf

The Canadian Maple Leaf gold coin is recognized globally for its purity, refinement, and beauty. Convenient in size, these gold coins are suitable for investors who prefer a physical investment they can hold in the palm of their hand.

Further, the Canadian Maple Leaf gold coin brings a legal tender worth $50 Canadian backed by the Royal Canadian Mint.

In addition, during the gold depression years, when some of the other mints reduced their gold coin production, Canada preserved its levels and ensured its coins were readily available.

Undoubtedly, buying gold coins for investment was getting financiers and keeping them to the standard of quality and assurance.

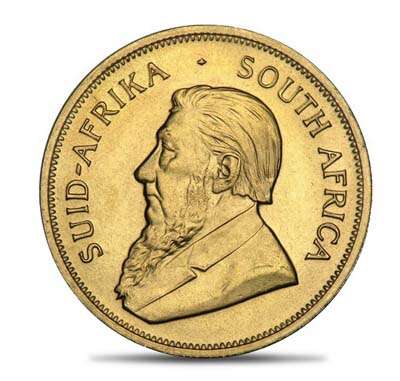

South African Krugerrand and Austrian Gold Philharmonic

Lastly, two other popular gold coins available for investment in 2024 and onwards are the South African Krugerrand and Austrian Gold Philharmonic.