Stagflation is a word feared by most central banks. As frightening as this word is for big banks, investors and individuals also need to be alarmed, and we’re going to explain why.

Right now, investors are growing increasingly uneasy as alarming trends take shape in the U.S. economy. Concerns are mounting over the possibility of stagflation—a scenario where inflation rises sharply while employment declines.

In this post, we’ll cover what stagflation in economics is, why you should feel worried about stagflation, and how to best protect yourself and your wealth.What Is Stagflation In Economics?

Stagflation is characterized by slow economic growth and rising or high unemployment. This economic stagnation is, at the same time, accompanied by rising prices i.e., inflation.

Stagflation is characterized by slow economic growth and rising or high unemployment. This economic stagnation is, at the same time, accompanied by rising prices i.e., inflation.

In other words, stagflation can be defined as a period of high inflation combined with a decline in the Gross Domestic Product (GDP).

The term stagflation was invented when talking about inflation on one side and stagnation on the other.

It was also used to describe the recessionary period in the 1970s following the oil crisis when the US underwent a recession that saw five quarters of negative GDP growth.

Another theory is that the confluence of stagnation and inflation are results of poorly made economic policy. Also, harsh regulation of markets, labor, and goods in an otherwise inflationary environment is cited as the possible cause of stagflation.

What Is An Example Of Stagflation?

An example of stagflation is what happened when the pandemic hit and the Fed started printing currency out of thin air. This increased the money supply and created inflation. Prices went up and taxes were raised, which slowed down economic growth. Hence, resulted in stagflation.

Trump’s Tariffs, rising inflation, and slowing growth spark renewed fears of stagflation. The Federal Reserve’s recent economic outlook has only fueled these fears, triggering an 8% drop in the S&P 500 from its record peak.

Joe Brusuelas, Chief Economist at RSM, warns that the country could be entering a phase of “stagflation-lite,” a troubling prospect that could spell serious trouble for retirement portfolios.

Why Is Stagflation Happening Now?

The reason Quantitative Easing (QE) or stimulus didn’t lead to inflation post-2008 was that the Fed sterilized its monetary injections by paying interest on excess reserves.

So, despite increasing the monetary base significantly, those increases largely didn’t impact the total money supply. At least, not to the extent that you would normally expect if the money multiplier had taken effect.

Fast forward to 2020, and all of a sudden the Fed was driving up the monetary base once again. Only this time, it wasn’t taking care to sterilize all of this monetary injection.

And the result was that the money supply began to grow faster and faster, with that inflation of the money supply resulting in rising prices.

Is the 1970s Stagflation Returning?

While the economy hasn’t yet reached the severity of the 1970s stagflation era, some experts warn that early warning signs are beginning to show. Back then, surging oil prices and misguided policy decisions fueled the crisis.

Today, parallels are being drawn as the ballooning national debt and ongoing monetary expansion are adding fuel to inflation. In fact, the current surge in the money supply may pose an even more immediate challenge than it did decades ago, making efforts to control inflation all the more difficult.

Why You Should Feel Worried About Stagflation Right Now

The reason why you should feel worried about stagflation is that it combines economic stagnation with severe inflation. Normally when you have a recession, prices drop so that malinvested resources throughout the economy can be put to better use. As a result, those falling prices help clear out “dead wood” from the economy and help aid the recovery process.

A process everyone is used to…However, stagflation is different.

In a stagflationary recession, you have business slowdown, rising unemployment, widespread economic dislocations, as well as rising prices. When the economy is contracting, what incentive do businesses or individuals have to pay more for goods and services?

None whatsoever!

That being the case, the stagflationary environment results in a very slow, painful, protracted recession. And a recovery that could take years to recover from. So, if the coming recession ends up seeing a return to 1970s-era stagflation, millions of Americans are going to be in a world of pain.

How To Best Protect Yourself Against Stagflation

As mentioned, if stagflation sets in and we do see a repeat of the 1970s, it could significantly harm millions of Americans. And those who stand the best chance of making it through stagflation are those who anticipate it and position themselves to protect against its worst effects.

So, what would that be, you probably wonder?

The key to protecting your wealth in times like these is assets that maintain their value in the face of inflation, like physical gold and silver.

The key to protecting your wealth in times like these is assets that maintain their value in the face of inflation, like physical gold and silver.

During the last stagflation, gold ended up making annualized gains of 30% over the course of the decade. And we may see a similar trend during the next stagflationary episode. Not to mention, the fact that gold saw annul gains of over 40% last year and has been staying steady on the $3,000 level for weeks now.

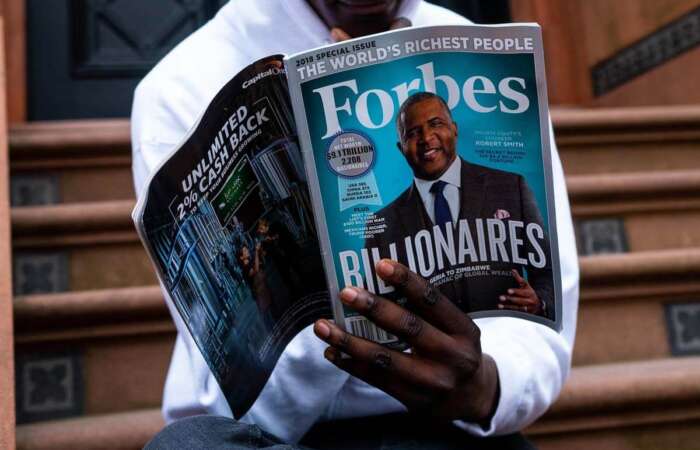

Additionally, billionaires like Thomas Kaplan believe that gold is on the cusp of a new decade-long bull market that will push the price well past $5,000 an ounce.

For more information, you can watch Augusta Precious Metal’s video on What is Stagflation? [Economics Made Simple]:

If you are ready to take action to secure your wealth, >>>>see our list of the top 7+ precious metals IRA companies (cash sales also available).

Or, request your FREE Gold & Silver Guide Today!