Thank you for taking a moment to read our Goldco vs Noble Gold Investments review.

Goldco and Noble Gold Investments are two significant vendors in the precious metals and gold IRA industry, and they both have many loyal customers and are well-regarded in the business.

However, which precious metals dealer is the best? To help you decide for yourself, we’ve compared both companies to see which has the advantage.

In this article, Goldco vs Noble Gold, we compare the two companies in terms of ratings, products, and services to find their similarities and what sets them apart.

| Goldco | Noble Gold Investments |

| >> Get 10% Back in FREE Silver | >> Free Gold & Silver Guide |

|

|

Tax-Beneficial IRA Investment

Before we compare Goldco vs Noble Gold Investments, let’s take a quick look at how precious metals can be used in tax-beneficial IRA investments.

Investing in Gold IRAs offers tax benefits and stability in the market, making them a favored option for astute investors. Across generations, entrusting one’s wealth to precious metal coins, bars, and bullion has proven to be a reliable wealth preservation strategy, especially during economic instability.

In today’s financial landscape, precious metal coins exhibit resilience as assets that can help safeguard your retirement nest egg.

Selecting the best gold IRA company to oversee your account is essential to harness these advantages fully. These specialized firms provide expert guidance in acquiring and securely storing your gold investments, ensuring their long-term safety and viability.

Nevertheless, it’s wise to consult a financial advisor before transitioning from a traditional IRA to comprehend the benefits and potential risks of gold IRA accounts.

Next, let’s explore further our comparison of Goldco vs Noble Gold to determine the superior choice.

Goldco Vs Noble Gold – Years In Business

Goldco has helped thousands of people diversify, grow, and protect their wealth for over a decade with gold, silver, platinum, and palladium.

Goldco has helped thousands of people diversify, grow, and protect their wealth for over a decade with gold, silver, platinum, and palladium.

Based in Calabasas, California, Goldco is run by CEO Trevor Gerszt, who has a long history in commercial real estate and investment strategies.

Noble Gold Investments, in contrast, has been in business since 2017.

Although they don’t have the years of experience Goldco has, Noble Gold has established itself as a reputable precious metals dealer.

Headquartered in Pasadena, California, Noble Gold’s CEO is Collin Plume, a seasoned money manager with more than 15 years of experience in insurance, real estate, and precious metals investment.

Headquartered in Pasadena, California, Noble Gold’s CEO is Collin Plume, a seasoned money manager with more than 15 years of experience in insurance, real estate, and precious metals investment.

Overall, both companies service precious metals IRAs, also called gold IRAs, and offer a large selection of gold and silver coins and bars for individual purchases.

Let’s examine how these two companies rate on the various business assessment sites.

Goldco Vs Noble Gold – Ratings & Customer Reviews

Both companies excel in customer reviews on business rating sites like the Better Business Bureau, Business Consumer Alliance, Trustpilot, TrustLink, and Consumer Affairs.

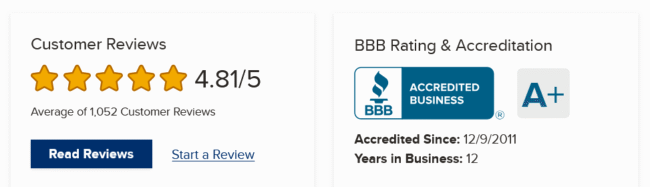

Goldco’s Ratings

Goldco has an excellent reputation online.

- Goldco has an A+ Rating from the Better Business Bureau (their highest rating) and a 4.81 of 5-star rating based on 1,052 customer reviews

- The Business Consumer Alliance gives Goldco a AAA rating (their highest rating) and a 4.8 out of 5-star rating based on 1555 customer reviews

- Goldco also has a total of 2673 customer reviews on Google with a 4.9 average star rating

- Trustlink gives Goldco an average 5 star rating based on 254 reviews

- They also have a 4.9 average star rating based on 1687 customer reviews on Consumer Affairs

- On Trustpilot, Goldco has collected 1512 reviews with a 4.8 average star rating

As you can see, Goldco’s ratings are numerous, outstanding, and among the highest a business can obtain.

Noble Gold Investments Ratings

Noble Gold also boasts an excellent reputation, with ratings slightly higher than some of its longer-standing competitors.

- They have an A+ rating with the Better Business Bureau (BBB) and are accredited with the organization, something not all precious metal dealers can claim. Additionally, they have a 4.98 out of 5 rating on the website based on 92 customer reviews, all of which speak highly of the company and its services

- Further, the Business Consumer Alliance (BCA) gives them an AA rating, which is not the highest rating possible but is close. They have 1 closed complaint on the website and received a 5 out of 5 star rating based on 4 reviews

- Finally, ConsumerAffairs shows a 5 out of 5-star rating based on 153 ratings, with almost all reviews being 5-star and no reviews under 3 stars

While both companies have superior ratings, we can see that Goldco has been reviewed more frequently and has thousands of reviews on popular watchdog sites, compared to Noble’s reviews in the hundreds. This is likely due to Noble Gold’s shorter time in the business.

But despite the difference in the number of reviews, customers seem equally happy with both precious metals dealers.

Goldco Customer Reviews

Noble Gold Customer Reviews

Overall, the reviews attest that both precious metals vendors are well-run and well-liked by their clients.

Next, we compare Goldco vs Noble Gold regarding products and services.

Products & Services Comparison

In this section, we compare Goldco’s vs Noble Gold in terms of product offerings.

Gold IRA/Precious Metals IRA

Goldco and Noble Gold offer Gold IRAs and the ability to roll over or transfer parts of your 401(k), TSP, SIMPLE, and SEP-IRA or similar retirement account into a precious metals IRA.

As an experienced and reputable gold IRA investment company, Goldco excels not only at customer service but also in terms of product offerings.

Therefore, the company can meet all your precious metals investment needs with its extensive inventory. They feature hundreds of coinage and bar options, making them one of the top precious metal investment companies in business today.

Noble Gold also maintains a large selection of gold, silver, platinum, and palladium coins and bars. Most of their products are IRS-approved in terms of quality and purity.

Either company can provide you with the coins and bars you desire to use for your investment strategy. And the quality of their products allows you peace of mind concerning the stability of your investment.

Now, let’s look at their gold IRA rollover and transfer process.

Gold IRA Rollover & Transfer

With Goldco and Noble Gold, you can easily roll over funds from various retirement accounts into a gold IRA. These retirement accounts include:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Roth 401(k)

- Roth 457(b)

- 401(k)

- 403(b)

- And TSP

Both companies make the gold IRA rollover or transfer process easy and guide you through it step-by-step.

You can set up a Gold IRA in three basic steps:

✓ Sign Your Agreement

✓ Fund Your Account

✓ Select Your Precious Metals

The entire process is straightforward and takes about 10 days from start to finish. If you’d like to learn more about adding precious metals to your IRA, request the free guides below from the gold IRA company of your choice.

When you request these guides, you’ll also get a call from a Precious Metals Specialist within 15 minutes or so that can answer all your questions.

>> Goldco Free Ultimate Guide to Gold & Silver

>>> Noble Gold Free Investment Kit

Regular Precious Metals Purchases

While both companies offer precious metal IRAs, they are also happy to engage in sales of individual coins and bars, like any other precious metals dealer.

Goldco and Noble Gold offer a wide selection of bullion and premium coins and bars in gold, silver, platinum, and palladium.

Knowing the origins of the coins and bars is essential when buying precious metals. And here you rest at ease since both companies offer IRS-approved precious metals of outstanding quality and purity.

For more details on precious metal options, feel free to visit each company’s website.

To summarize this section of our Goldco vs Noble Gold comparison, you can rest assured that you’re investing in top-quality precious metals.

Goldco Vs Noble Gold Buy-Back Policy

Both companies offer a buy-back program when it’s time to liquidate your precious metals.

Goldco features its “Highest Buy-Back Guarantee,” which means that Goldco will repurchase your metals from you at a much better price than other coin dealers. This is a good safety net to have when making a large purchase.

Goldco features its “Highest Buy-Back Guarantee,” which means that Goldco will repurchase your metals from you at a much better price than other coin dealers. This is a good safety net to have when making a large purchase.

Similarly, Noble Gold’s “No-Quibble Buyback” program promises to make liquidating your precious metal investments easy.

Additionally, their buy-back policy also covers if you have opened a gold IRA or silver IRA but change your mind. In these cases, Noble Gold will also buy back your precious metals.

Continuing our comparison – Goldco vs Noble Gold, let’s next examine fees and pricing.

Fees & Pricing Comparison

Now that you have read this far in our review, you’re likely wondering about fees and pricing, so here’s a quick comparison of Goldco vs Noble Gold annual costs.

Goldco Fees

- $80 annual custodian fee

- A $100 yearly maintenance fee

- $100 for non-segregated storage and $150 for segregated storage

- A $25,000 minimum purchase requirement IRA

- $3,500 minimum purchase requirement for regular purchases

- Keep in mind the cost of precious metals fluctuates with the market value

>>> Learn more about Goldco’s fees

Noble Gold Fees

Noble Gold stands apart from other competitors in the industry with their IRA minimum investment of only $2,000.

Moreover, do note that this smaller investment amount only applies if you buy precious metals directly or transfer your IRA. If you are rolling over, the minimum investment you can make is $5,000.

In terms of fees, Noble Gold charges an annual custodial fee of $80 and an annual storage fee of $150.

>>> Learn more about Noble Gold’s fees

Goldco Vs Noble Gold – Promotions

If you’re considering buying precious metals from any of these companies, you may be interested in current promotions for each dealer.

- Goldco offers up to 10% of your order in FREE silver. This means that if you purchase metals for $100,000, you get $10,000 in FREE silver!

- They also offer the highest buy-back guarantee on the market

- And a FREE Gold & Silver Guide to learn more about adding gold and silver or other precious metals to your IRA

- Noble Gold offers its no-quibble buyback policy

- They also provide a Free Gold & Silver Guide

Now that you know about the companies’ backgrounds, products, and fees, let’s explore Goldco vs Noble Gold in terms of their overall pros and cons.

Pros And Cons Of Goldco Vs Noble Gold Investments

Okay, we’re almost at the end of our Goldco vs Noble Gold review. Let’s summarize what we’ve learned up until now in terms of the pros and cons of each company.

✓ A+ BBB rating & AAA BCA rating

✓ Outstanding customer reviews

✓ Unmatched customer service

✓ Dedicated Precious Metals Specialist

✓ Easy IRA & 401(k) rollovers

✓ No high-pressure sales tactics

✓ Highest buy-back guarantee

✓ Endorsed by Sean Hannity, Chuck Norris, and Ben Stein

✓ Free storage and free shipping on non-IRA precious metals

✓ Cannot set up an account online

✓ A+ BBB rating & AA BCA rating

✓ Outstanding customer reviews with few complaints or negative comments

✓ One of the most competitive IRA minimum investment requirements at $2,000 and $5,000 minimum for rollovers

✓ An affordable annual custodial fee of $80 and an annual storage fee of $150

✓ A user-friendly website and excellent customer support

✓ Easy and stress-free IRA setup with a streamlined process

✓ A no-quibble buy-back policy

✓ Endorsed by TV Personality Charlie Kirk

✓ Only one US storage option – the International Depository Service in Dallas, Texas

✓ Similar to Goldco, you can’t set up an IRA account online

Goldco Vs Noble Gold Investments – Which Company Should You Choose?

Goldco and Noble Gold are both superb options for Gold IRA investments. However, even though they offer similar products and services, there are some differences between the two companies.

Let’s review some factors that differentiate the two vendors:

For example, you should pick Goldco if…

- Security and stability are important to you, and you feel safe knowing that thousands of customers praise Goldco and its customer service and no-pressure sales approach

- You’re interested in free IRA and 401(k) rollovers

- Precious metals are going to be part of your ongoing investment strategy

- Free storage and shipping for non-IRA precious metals is appealing

- You want 10% of your order in FREE silver

>>> To learn more, request your Free Gold & Silver Guide from Goldco

You should pick Noble Gold Investments if…

- Having a large variety of investment options, including gold, silver, platinum, and palladium to choose from is important

- Noble Gold’s minimum IRA investment amount of $2,000 and $5,000 for rollovers suits your budget

- Having an easy-to-use company website is important to you

- You’re interested in low fees of $80 annual custodial fee and $150 for yearly storage

>>> Request Noble Gold’s FREE Gold & Silver Guide

Goldco Vs Noble Gold – Which Is Best?

If you want to diversify your retirement portfolio, consider adding precious metals to your investment mix. Fortunately, you can do this with significant tax benefits through a gold IRA. You only need a brokerage or gold IRA company to arrange it for you.

There are many precious metal dealers. How do you know which companies to trust with your investment? As we said at the start of this review, two names consistently come up in the industry: Goldco and Noble Gold Investments.

So, to help you decide which is best – Goldco vs Noble Gold – we conducted extensive research in putting this review together. What was our verdict?

Based on all the review criteria, Goldco is the better option. One reason for this is the overwhelmingly positive reviews Goldco receives. They truly set the bar high in this industry. Also, another reason is Goldco’s extensive inventory of precious metals and its numerous options for IRS-approved repositories.

While Noble Gold Investments has made a name for itself, it’s hard to deny the prestige of being considered the “best overall Gold IRA company” everyone else is measured against – and that’s precisely what Goldco is known for.

Ultimately, your own decision should depend on your individual needs and preferences. We recommend that you take some time to explore both Goldco and Noble Gold’s offerings and see which one aligns better with your investment goals.

The good news is that with either company, you can rest assured that you’re working with a reputable and trustworthy vendor that will help you diversify your retirement portfolio with precious metals.

>> Read the full Goldco Review or request the Free Retirement Savings Survival Guide

>>> Read the full Noble Gold Investment Review or request the Free Gold & Silver Guide

Goldco Vs Noble Gold Alternative Gold IRA Providers

Remember, you have investment options. You can choose Goldco, Noble Gold, or any other precious metal providers to work with.

To help inform your decision-making process, we have reviewed and rated the industry’s top 8+ precious metals companies for regular purchases and gold IRAs.

Our ratings are based on various factors, including BBB/BCA ratings and complaints, customer reviews, annual fees, precious metals selection, storage options, promotions, and buy-back programs.

One last perk – you can request a free guide/kit from each company by clicking on the “GET FREE KIT!” button at the right.

>

FAQs

What is a gold or precious metals IRA?

A Precious Metals IRA, commonly called a Gold IRA, represents a distinct variety of self-directed retirement accounts meticulously crafted to safeguard precious metals like gold and silver. These accounts are experiencing growing popularity as individuals seek alternative avenues for enhancing the diversity of their retirement portfolios.

One notable advantage of a Gold IRA lies in its ability to accommodate pre-tax contributions, leading to the potential accumulation of investment earnings on a tax-deferred basis. This aspect carries significant merit when strategizing for retirement.

In contrast to conventional IRAs, which predominantly comprise paper assets such as stocks and bonds, a Gold IRA exclusively holds physical assets like gold, silver, or other valuable metals. This can be particularly enticing for investors aiming to shield their retirement funds from economic upheavals and the erosive effects of inflation.

Why invest in a gold IRA?

Individual Retirement Accounts (IRAs) can be pivotal when securing your retirement and ensuring your family’s financial stability.

What makes these specialized accounts so appealing is their capacity to shelter savings from taxes, allowing them to grow over time. However, as with any long-term investment strategy, allocating a significant portion of your assets to dependable and trustworthy investments is essential.

In an IRA, you can include assets such as cash, stocks, ETFs, etc. Yet, cash is rapidly losing value, and inflation is spiraling out of control. Without something tangible to underpin it, your savings could diminish substantially in the future.

Moreover, you genuinely require an asset that maintains its value and appreciates over time. And there’s no superior investment option for this purpose than gold.

Uncertainty has never been more pronounced in the current global economic climate marked by lockdowns, supply shortages, geopolitical conflicts, inflation, and the looming threat of recession. Consequently, many investors incorporate physical gold into their IRAs to safeguard their financial future. A Gold IRA investment has demonstrated its prowess as a robust hedge during crises that adversely impact most other asset classes.

Speaking of risk, it’s paramount to grasp the prevailing economic conditions. However, with gold, you can find solace in the knowledge that you possess an asset consistently in demand, preserving its value over time. Furthermore, gold is an ideal diversification tool to shield against potential losses in other investments.

Further, it’s worth noting that a Gold IRA can be a prudent investment strategy, though it may only suit some. Before making any decisions, you should seek counsel from a financial advisor to determine whether a Gold IRA aligns with your unique financial circumstances.

Where should I store my gold?

The IRS has implemented stringent regulations mandating that any bullion held within your IRA account must be stored in an accredited depository.

This means you cannot merely tuck your gold bars into a home safe or stow them beneath your mattress for safekeeping. Instead, a separate entity must be responsible for the management and secure storage of your precious metals while your Custodian handles your day-to-day paperwork.

Fortunately, most reputable gold IRA companies have partnered with reliable custodians to ensure your metals’ secure storage.

These custodians undergo thorough vetting and have a proven history of delivering exceptional storage solutions to their clients. However, if you, for any reason, are dissatisfied with any of the affiliated custodians, you can just introduce your compliant depository into the equation.

When searching for a depository, it is imperative to confirm its compliance with all regulatory requirements. Brink’s, Delaware Depository, and IDS are among the leading depositories in the market. While all three offer first-rate storage options, it’s noteworthy that IDS stands alone in providing segregated storage.

Regardless of the depository you select, all three offer similar benefits and are renowned for their reliability and security. So, exploring your choices thoroughly and identifying the best storage solution for your IRA gold is essential.

When can I take distributions?

Once you’ve reached the eligible age for initiating disbursements from your account, typically around 59 ½ years, you have a couple of options. You can opt to receive the funds in cash value or arrange to have the physical metals shipped directly to you.

However, it’s important to note that taking these actions may result in taxation and potential liability to the IRS due to early withdrawals. In essence, it’s advisable to regard a Gold IRA as a long-term retirement investment and hold it until maturity. Nonetheless, it’s essential to keep in mind that mandatory payments must commence at the age of 70 ½.

Is a gold IRA a safe investment?

Let’s approach this question differently and ask: “Can your IRA genuinely remain secure without including gold?”

Historically, gold prices move inversely to paper assets such as stocks and bonds. Incorporating a Gold IRA into a retirement portfolio enhances diversification and acts as an insurance policy against inflation.

This, in turn, mitigates risk, particularly over extended time horizons, rendering it a savvy choice for retirement investments like IRAs. You can refer to our article on gold IRA pros and cons for a more comprehensive examination.

What types of retirement accounts can be transferred to a gold IRA?

You can transfer any type of retirement account, including a Traditional IRA, Roth IRA, 401(k), or other pension plans, to a Gold IRA if the account custodian or trustee allows it.

Here’s the complete list of transferable retirement accounts:

- Employer-sponsored 401(k)

- Self-directed 401(k)

- Traditional or Roth IRA.

- TSP

- 403(b)

- 457(b)

- SEP IRA

If you still have questions, read more Gold IRA FAQs.