Thank you for visiting our Oxford Gold Group review for 2026. In this review, we’ll go over Oxford Gold Group’s products, annual fees, reviews, pros & cons, and more to give you an idea of who you might be working with in case you decide to choose Oxford as your precious metals company.

With that being said, let us now look at how Oxford Gold Group measures up! Please feel free to use the quick links in the TOC list to jump straight to any section:

What Is Oxford Gold Group?

For whatever reason, Oxford Gold Group is one of those companies with a scarce profile and background. As we tend to point out, this isn’t necessarily a bad thing and certainly not an indicator of anything naughty: some companies just prefer not to keep that side of their profile open to the public.

For whatever reason, Oxford Gold Group is one of those companies with a scarce profile and background. As we tend to point out, this isn’t necessarily a bad thing and certainly not an indicator of anything naughty: some companies just prefer not to keep that side of their profile open to the public.

Oxford Gold Group is, as you might have guessed, both a dedicated IRA provider and a bullion vendor. That means you can purchase physical gold and silver from them within an IRA as well as have it delivered outside of it.

Past that, there aren’t many details about the company available.

Through their Better Business Bureau page, we know that they’ve been in business for only five years, which is among the briefest periods we’ve come across.

The About site likewise doesn’t tell us much about the California-based company, though it says that any customer can deal directly with a Managing Partner, which is presumably not just an account manager.

They also outline their approach, underscoring how important it is for them to achieve customer satisfaction and mentioning their all-inclusive guidance process for IRA customers.

How To Buy Gold From Oxford Gold Group

As tends to be the case with IRA companies, there are no Oxford Gold Group prices listed for any of the products. This is oftentimes, though not always, the result of a company not wanting to reveal their markup, but also because precious metals prices change daily.

You can opt to buy gold and silver from Oxford Gold Group either as an independent customer, so to speak, or one that will open an IRA account with them.

Should you opt for the latter, you’ll have an account manager assigned to you, but more on that later. Anyone interested in Oxford’s products has to reach out to the company first: there is no way to simply make an online shop-style purchase.

The products section is very straightforward and no-nonsense, both in description and offerings. It has an assortment of bullion that is almost exclusively IRA-eligible, with some notable exceptions. All four precious metals are covered, with gold and silver obviously having the widest product offering.

With that said, here’s an overview of what you can find in the inventory right now:

Gold

- American Gold Eagle, bullion and proof, 1oz

- Canadian Gold Maple Leaf, 1oz

- American Buffalo, 1oz

- Austrian Gold Philharmonic, 1oz

- South African Krugerrand, 1oz

- Various Canadian Wildlife-themed gold coins, 1/4oz, and 1/10oz

- Various Australian Wildlife-themed gold coins, 1/4oz

- Gold bars, 1oz, and 10oz, from various manufacturers

Silver

- American Silver Eagle, bullion and proof, 1oz

- Canadian Silver Maple Leaf, 1oz

- Austrian Silver Philharmonic, 1oz

- Various Canadian Wildlife-themed silver coins, 1.5oz

- Various Australian Wildlife-themed silver coins, 1.3oz, and 1.5oz

- America the Beautiful, 5oz

- Many different “junk silver” coins, individually listed

- Silver rounds, 1oz

- Silver bars, various mints, 1oz, 10oz, and 100oz

- PAMP Suisse silver bars, individually listed, 100oz and 1kg

Platinum

- American Platinum Eagle, proof, 1oz

- Australian Dolphin Platinum coins, 1/3oz and 1.5oz

- Canadian Platinum Maple Leaf, 1oz

- Austrian Platinum Philharmonic, 1oz

- Platinum bars, various mints, 1oz

Palladium

- Canadian Palladium Maple Leaf, 1oz

- Palladium bars, various manufacturers, 1oz

If you are ready to take action, >>>>see our list of the top 9 precious metals IRA companies (cash sales also available).

What Retirement Accounts Do They Offer?

As is the norm in this industry, Oxford Gold Group offers the option to open either a gold or silver IRA through them. This self-directed IRA is more than likely an improvement over whatever retirement vehicle you have now, as you’ll get to steer your investments without worrying too much about the details.

As is the norm in this industry, Oxford Gold Group offers the option to open either a gold or silver IRA through them. This self-directed IRA is more than likely an improvement over whatever retirement vehicle you have now, as you’ll get to steer your investments without worrying too much about the details.

It’s also the norm to work with both third-party custodians and depositories to handle the paperwork and store the bullion in your IRA, but Oxford Gold Group doesn’t mention any companies facilitating the latter.

Judging by the Oxford Gold Group IRA reviews, though, we’d say this part is well-polished. The custodians listed are STRATA and Equity Institutional, with the option to utilize others presumably available.

Oxford Gold Group Annual Fees And Investment Minimums

Their fee structure is outlined as follows:

- $175 annual maintenance fee for IRAs valued under $100,000 and $275 for those valued over $100,000

- $175 to $225 storage fee, covered by Oxford Gold Group for up to five years. The difference in storage most likely has to do with whether you are holding only gold or other precious metals in the IRA

- No shipping fees

- $7,500 minimum purchase in an IRA

- $1,500 minimum non-IRA purchase

| Annual Fees | Custodial Fees | Investment Minimums |

| $175 (for IRAs valued under $100,000)

$275 (for those valued over $100,000) |

$175 to $225 (Covered by Oxford Gold for 5 years) | Precious Metals IRA $7,500

Regular Purchase $1,500 |

The newly-created IRA can be either a Traditional or Roth IRA depending on your preferences, with additional customizations available. This account, besides the custodian, will also be managed by the representative you’re assigned, often early on.

If you are ready to take action, >>>>see our list of the top 9+ precious metals IRA companies (cash sales also available).

Oxford Gold Group IRA Reviews

![]()

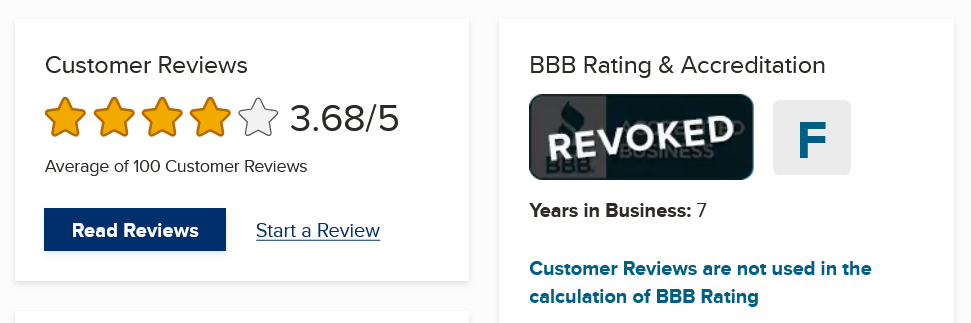

Oxford Gold Group IRA reviews were overwhelmingly positive once upon a time. But that has recently changed!

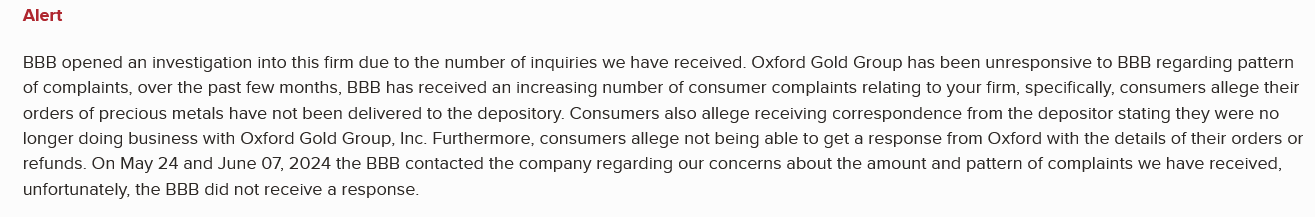

On 06/25/2024 this business’s accreditation in the BBB was revoked by the BBB’s Board of Directors due to failure by the business to adhere to the BBB requirement that Accredited Businesses meet and abide by the BBB’s standards. This is alarming news. We would NOT move forward with this company despite other (prior) good reviews.

They still have a 5 out of 5 star rating on the Business Consumer Alliance page based on 39 reviews, and an AA rating from the website itself.

However, on the Trustpilot page, Oxford Gold Group went from this:

To this rating:

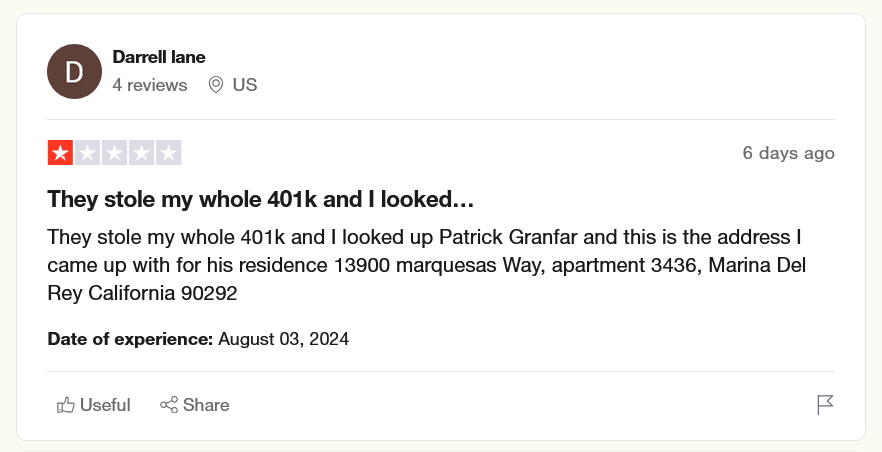

People talk about how they were swindled and that Oxford Gold Group has stolen their whole 401(k), which is very alarming.

Oxford Gold Group Complaints

Oxford Gold Group complaints are growing in huge numbers and they are currently in several lawsuits.

Additionally, the BBB has also revoked their accreditation and issued this alert:

Again, don’t do business with this company.

For a safe investment, you should consider investing with any of these top-rated precious metals and gold IRA companies.

Pros And Cons Of Oxford Gold Group

- $7,500 is one of the lowest investment minimums you’ll come across for a gold or silver IRA

- Good selection of products, clearly meant to appeal to retirement investors

- Specialized approach to retirement investment as opposed to just bullion dealership

- Currently in several lawsuits

- BBB Accreditation revoked

- Lots of bad reviews from customers being scammed of their whole investment

- No prices or markup listed

- Somewhat high minimum for non-IRA purchases, though not unusually so

- It seems the easiest way to spring them to action is to file a complaint

Verdict Oxford Gold Group Review (2026): Legit?

NO! Oxford Gold Group WAS a good name in the gold IRA industry that’s currently under several alarming lawsuits for stealing people’s whole investments. They also got their BBB Accreditation revoked in June 2024 and were issued an alert.

NO! Oxford Gold Group WAS a good name in the gold IRA industry that’s currently under several alarming lawsuits for stealing people’s whole investments. They also got their BBB Accreditation revoked in June 2024 and were issued an alert.

With several customer reviews stating that Oxford Gold Group has stolen their whole investments, they aren’t considered a legit precious metals company anymore.

We do not recommend investing your money with this precious metals company!

To ensure you’re investing your hard-earned money with a legit gold IRA firm, see our list of top-rated precious metals companies below.

>

Or, you can get a free gold and silver investment kit from our #1 recommended precious metals investment company.

Or, you can see if you qualify for their ===> get up to $10,000 in FREE silver promotion.

If not, you can go directly to Oxford Gold Group website.