Thank you for visiting our Goldco vs Augusta Precious Metals review. Goldco and Augusta are two of the biggest players in the precious metals and Gold IRA industry and they have both earned a stellar reputation.

But which gold and silver dealer is better? Read our comparison of both precious metals companies and see which of them stands out!We’ll cover all important aspects to consider when choosing a precious metals and Gold IRA company and their similarities and what sets them apart.

Let’s start with a quick overview:

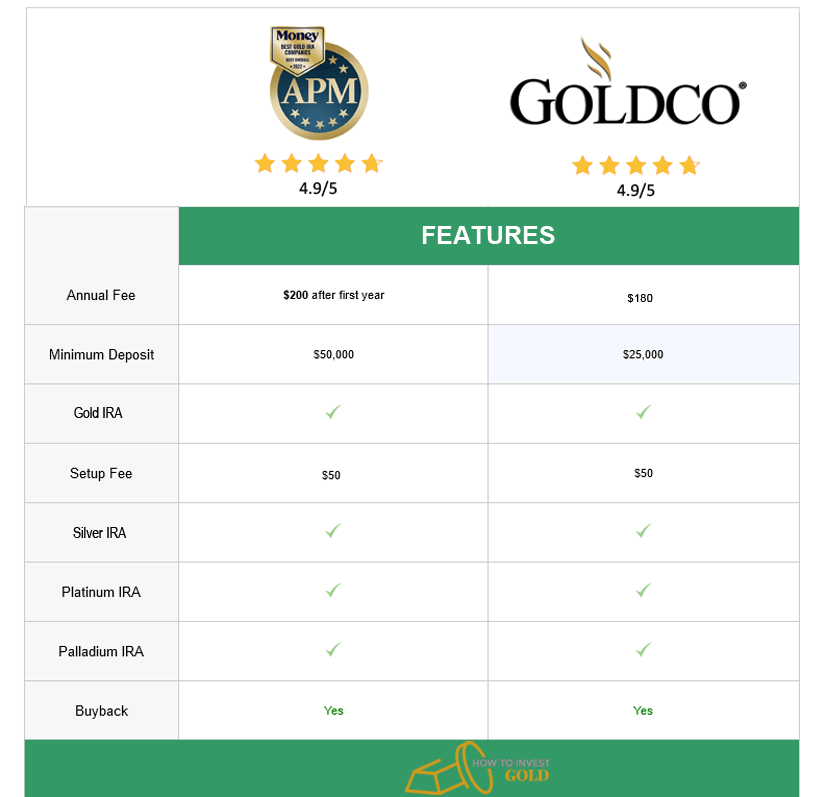

| Augusta Precious Metals | Goldco |

| >> Get paid in REAL Gold | >> Get 10% back in FREE silver |

|

|

Tax-Beneficial IRA Investment

Gold IRA investments offer tax advantages and market stability for retirement accounts, making them a popular choice for savvy investors. For generations, investing in precious metal coins, bars, and bullion has been a trusted strategy for wealth preservation, especially in times of economic uncertainty.

Gold IRA investments offer tax advantages and market stability for retirement accounts, making them a popular choice for savvy investors. For generations, investing in precious metal coins, bars, and bullion has been a trusted strategy for wealth preservation, especially in times of economic uncertainty.

In the current financial climate, gold and other precious metals remain resilient assets that can help protect your retirement savings.

To take advantage of these benefits, it’s crucial to choose the best gold IRA company to manage your account. These specialized firms offer expert guidance on purchasing and storing your gold investments, ensuring their safety and viability over the long term.

However, it’s important to seek advice from a financial advisor before making the switch from a traditional IRA, to fully understand the advantages and risks of Gold IRA accounts.

By adding gold to your retirement portfolio, you can diversify and strengthen your investments, ensuring a secure financial future. So, let’s take a look at two of the industry-leading precious metals and Gold IRA companies to see which company is the better choice.

Goldco vs Augusta Precious Metals – Years In Business

Both Goldco and Augusta Precious Metals have been in business for over a decade helping thousands of people to diversify, grow, and protect their wealth with physical metals such as gold, silver, platinum, and palladium. Both companies offer Precious Metals IRAs, also called Gold IRAs, as well as regular cash purchases of gold and silver coins and bars.

Goldco is run by Trevor Gerszt and has its headquarters in Calabasas, California.

Augusta Precious Metals, on the other hand, was launched in 2012 by founder and CEO Isaac Nuriani and is headquartered in Casper, Wyoming.

Both precious metals companies have similar times in business, plus-minus a few years, and have plenty of experience in assisting Americans with their precious metals investments and IRA accounts.

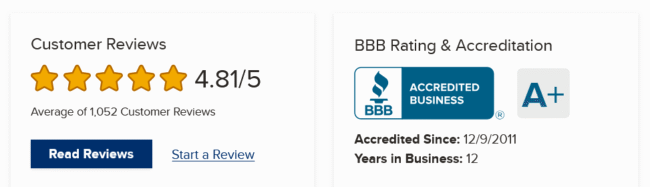

Goldco vs Augusta Precious Metals – BBB Ratings & Reviews

Both companies shine when it comes to customer reviews on trusted watchdog sites like the Better Business Bureau, Business Consumer Alliance, Trustpilot, TrustLink, Consumer Affairs, and more.

Both Goldco and Augusta have an A+ BBB Rating and AAA BCA Rating, which is a great accomplishment for both contenders. However, the number of customer reviews on these sites varies. For example, Goldco has collected 1,052 customer reviews with an average rating of 4.81/5 stars.

And Augusta has a 4.95/5 star rating based on 121 customer reviews.

Overall, we can see that Goldco is reviewed more frequently and has thousands of reviews on popular watchdog sites, compared to Augusta’s reviews in the hundreds, which indicates that Goldco is either doing more business or have a better system for collecting reviews.

Additionally, it could also be a result of the difference in investment minimums for gold IRAs and regular cash purchases, where Augusta has a higher investment minimum of $50K compared to Goldco’s $25K for Gold IRAs and $3,5K for cash sales.

Naturally, there will be more individuals with retirement savings in the range of $25K+ rather than $50K+. Although, Augusta doesn’t cover up that their target audience is wealthier investors.

To give you another example, Goldco has gathered 1687 customer reviews on Consumer Affairs while Augusta Precious Metals has collected 133 reviews.

But despite the difference in the number of reviews, customers seem to be equally happy with both precious metals dealers.

Goldco Customer Reviews

Augusta Precious Metals Customer Reviews

Across the board, the reviews confirm that both contenders act professionally and live up to their no-pressure sales and educational approach, which we appreciate.

Products And Services Comparison

Here’s a comparison of Goldco’s vs Augusta Precious Metals’ product offerings.

Gold IRA/Precious Metals IRA

Both Goldco and Augusta offer Gold IRAs and the option to either roll over or transfer parts of your 401(k), TSP, SIMPLE, and SEP-IRA or similar retirement account into a Precious Metals IRA.

As an experienced and reputable Gold IRA investment company, Goldco truly goes above and beyond to cater to its customer’s needs and desires. The company is a one-stop shop for all your precious metals investment needs. With its plethora of options and exceptional services, Goldco is without a doubt among the top investment companies in the market today.

Additionally, Augusta Precious Metals is known to offer an educational one-and-one webinar with Harvard-trained economist Devlyn Steele, which is an appreciated addition for beginner investors. You’ll, for example, learn that you’ve got plenty of options for diversifying your portfolio and making strategic investments that will pay off in the long run.

At the end of the day, if you’re serious about investing in precious metals and building a solid retirement portfolio, you should consider working with any of these companies. They’ve got the expertise, experience, and resources to help you succeed, and they’ll do whatever it takes to help you achieve your financial dreams.

Let’s take a closer look at their Gold IRA rollover and transfer process.

Gold IRA Rollover & Transfer

With Goldco and Augusta, you can easily roll over funds from various retirement accounts into a Gold IRA, Silver IRA, or Precious Metals IRA, including:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Roth 401(k)

- Roth 457(b)

- 401(k)

- 403(b)

- And TSP

Both companies make the Gold IRA rollover or transfer process quick and pain-free and hold your hand from start to finish. We think this is where both companies truly shine and they go far and beyond to make sure their customers feel educated and comfortable with the whole Gold IRA setup process.

This is the Gold IRA setup process in short:

✓ Sign Your Agreement

✓ Fund Your Account

✓ Select Your Precious Metals

The whole process is easy and takes about 10 days from start to finish!

To learn more about adding precious metals to your IRA, request the free guides below from your choice of Gold IRA company. By requesting these guides, you’ll also get a call from a Precious Metals Specialist within 15 minutes, or so, that can answer all your questions.

>>>Goldco FREE Gold & Silver Guide

>>>Augusta Precious Metals Free Gold IRA Guide

Regular Precious Metals Purchases

When it comes to buying precious metals, it’s important to know where they’re coming from and who you’re buying them from. Thankfully, both companies source their coins and bars from top refineries all over the globe.

In addition, you can buy gold and silver coins and bars, as well as platinum and palladium, from both Augusta and Goldco. They have a wide selection of bullion and premium coins and bars.

Here are some popular gold coins and silver coins for IRA and non-IRA purchases for both companies:

Here are some popular gold coins and silver coins for IRA and non-IRA purchases for both companies:

-

- Gold or Silver American Eagles Coins

- Gold or Silver American Eagles (Proof Coins)

- Gold or Silver American Buffalos Coins

- Gold or Silver Canadian Maple Leafs Coins

- Australian Striped Marlin Coins

- Gold or Silver Austrian Philharmonics Coins

- American Silver Eagles Coins

- And Gold or Silver Bullion Bars

To recap this section of our Goldco vs Augusta Precious Metals comparison, you can rest assured that you’re getting your hands on nothing but top-quality bullion.

And while they do cater to those who want to invest in an IRA, you don’t necessarily have to be locked into that kind of commitment. They’re happy to ship their products out to you just like any other precious metals dealer.

Except for the above product selection, they also offer some variations in gold and silver coins and bars that you can find by either calling them or requesting their Free Gold IRA Guides.

>>>Goldco FREE Gold & Silver Guide

>>>Augusta Precious Metals Free Gold IRA Guide

Buy-Back Policy

Both contenders offer a buy-back program when it’s time to liquidate your precious metals.

However, the major difference is that Goldco offers a “Highest Buy-Back Guarantee,” which means that Goldco will buy your metals back from you at a much better price than other coin dealers. This is a good safety net to have when making a large purchase.

However, the major difference is that Goldco offers a “Highest Buy-Back Guarantee,” which means that Goldco will buy your metals back from you at a much better price than other coin dealers. This is a good safety net to have when making a large purchase.

Fees And Pricing Comparison

If you have read this far in our review, we bet you’re wondering about the fees and pricing, so here’s a quick comparison of Goldco vs Agusta Precious Metals’ annual fees.

Goldco Fees

- $80 annual custodian fee

- $100 annual maintenance fee

- $100 for non-segregated storage and $150 for segregated storage

- $25,000 minimum purchase requirement IRA

- $3,500 minimum purchase requirement for regular purchases

- Plus, the cost of precious metals fluctuates with the market value

>>> Learn more about Goldco’s fees

Augusta Precious Metals Fees

- $50 setup fee (waived by Augusta)

- $80 annual custodian fee (covered by Augusta for up to 10 years for qualifying accounts)

- $100 annual storage fee for non-segregated storage and $150 for segregated storage (covered by Augusta for up to 10 years for qualifying accounts)

- $50,000 minimum purchase requirement IRA

- $50,000 minimum purchase requirement for regular purchases

- Also, the cost of precious metals fluctuates with the market value

>>> Learn more about Augusta Precious Metals Fees

Goldco vs Augusta Precious Metals – Promotions

If you’re thinking of buying precious metals from any of these companies, you may be interested in current promotions for each dealer.

Goldco Promotions

- Goldco offers up to 10% of your order in FREE silver. Meaning that if you purchase metals for $100,000, you get $10,000 in FREE silver!

- Goldco also offers the highest buy-back guarantee on the market

- And a FREE Gold & Silver Guide where you can learn more about adding gold and silver or other metals to your IRA

Augusta Precious Metals Promotions

- Augusta, on the other hand, will waive all your fees for up to 10 years (every customer qualifies)

- The company also offers one-on-one educational web conferences with Harvard-trained economist Devlyn Steele

- And if you order the Ultimate Guide to Gold IRAs, you’ll Get Paid in Real Gold

Both companies have good promotions to help you get started with your precious metals investment.

Now that you know about the companies’ backgrounds, products, fees, pros and cons, and current promotions, let’s take a look at which company you should choose as your provider.

Pros And Cons Of Goldco

Okay, we’re almost at the end of our Goldco vs Augusta Precious Metals review. Let’s sum it up with some pros and cons of each company.

✓ A+ BBB rating & AAA BCA rating

✓ Outstanding customer reviews

✓ Unmatched customer service

✓ Dedicated Precious Metals Specialist

✓ Easy IRA & 401(k) rollovers

✓ No high pressure sales tactics

✓ Highest buy-back guarantee

✓ Endorsed by Sean Hannity, Chuck Norris, and Ben Stein

✓ Free storage and free shipping on non-IRA precious metals

Pros And Cons Of Augusta

✓ A+ BBB rating & AAA BCA rating

✓ Unique, free one-on-one educational web conference

✓ Up to 10 years of fees reimbursed to your IRA

✓ No-pressure sales approach

✓ Easy and stress-free IRA setup with a streamlined process

✓ Buy-back program

✓ Endorsed by Hall of Fame quarterback & multimillionaire Joe Montana

✓ Free guide on how to avoid gimmicks & high-pressure tactics used by gold IRA companies

✓IRA minimum deposits start at $50,000

✓ High minimum for regular purchases, starting at $50,000

✓Just like Goldco, you can’t set up an account online

Goldco vs Augusta Precious Metals – Which Company Should You Choose?

Goldco and Augusta are both fantastic options for Gold IRA investments. While they offer many of the same services, there are a few factors that set them apart and could sway your decision on which one to choose. Let’s break it down for you.

For example, you should pick Goldco if…

- You want a lower investment amount to start your Gold IRA account ($25,000 minimum deposit)

- You feel safe knowing that thousands of customers praise Goldco and their customer service and no-pressure sales approach

- You’re looking for free IRA and 401(k) rollovers

- You’re interested in holding wealth in gold and silver

- You want free storage and shipping for non-ira precious metals

- You want 10% of your order in FREE silver

>>> To learn more, request your Free Gold & Silver Guide from Goldco

You should pick Augusta Precious Metals if…

- You want a wide variety of investment options, including gold, silver, platinum, and palladium

- You have more than 50K to invest in your Precious Metals IRA

- You’re looking for a free educational webinar to learn more about precious metals investing before you press “GO”

- You want all your annual fees waived for up to 10 years

>>> To learn more, request your Free Gold IRA Guide from Augusta

Verdict – Which Precious Metals Company Is The Best?

If you want to diversify your retirement portfolio, you should consider adding some precious metals to the mix. Best of all, you can do this with serious tax benefits through a gold IRA. All you need is a brokerage or gold IRA company to arrange it for you.

That said, if you’re wondering which companies to trust with this sort of thing, two names consistently come up: Goldco and Augusta Precious Metals. But, after doing extensive research and putting this review together, we’re leaning towards Goldco as the better option.

One reason for this is the high praise that Goldco receives in their thousands of 5-star customer reviews, where people consistently mention their top-notch customer service and ease of starting a Gold IRA account with Goldco. They truly set the bar high in this industry.

Additionally, Goldco also has a lower investment minimum for Gold IRAs, half of Augusta’s minimum deposit, which allows them to cater to a broader market.

While Augusta Precious Metals has definitely made a name for itself, it’s hard to deny the prestige that comes with being considered the “best overall Gold IRA company” everyone else is measured up against – and that’s exactly what Goldco is known for.

Ultimately, your decision should depend on your individual needs and preferences. We recommend that you take some time to explore both Goldco and Augusta’s offerings and see which one aligns better with your investment goals.

Either way, you can rest assured that you’re working with a reputable and trustworthy company that will help you diversify your retirement portfolio with precious metals.

>>> Read the full Goldco Review or request the FREE Gold & Silver Guide

>>> Read the full Augusta Precious Metals Review or order the Ultimate Guide to Gold IRAs and get paid in Real Gold

Goldco Vs Augusta Alternatives

If any of these options seem right to you, we have reviewed and rated the top 9+ precious metals companies in the industry for regular purchases and gold IRAs.

We have rated each company on a variety of factors including BBB/BCA ratings and complaints, customer reviews, annual fees, precious metals selection, storage options, promotions, and buy-back programs. You can request a free guide/kit from each company by clicking on the “GET FREE KIT!” button to the right.

>

FAQ

What is a Gold IRA or Precious Metals IRA?

A Gold IRA, also called a Precious Metals IRA, is a unique type of self-directed retirement account that is specifically designed to hold precious metals like gold and silver. These types of accounts are becoming more popular as people look for alternative ways to diversify their retirement portfolios.

One of the benefits of a Gold IRA is that it allows for pre-tax contributions, which means that any investment earnings can accumulate tax-deferred. This can be a huge advantage when planning for retirement.

Unlike traditional IRAs that typically hold paper assets such as stocks and bonds, a gold IRA strictly holds physical gold, silver, or other metals. This can be appealing to investors who are looking for ways to protect their retirement savings against economic turmoil and inflation.

Why invest in a Gold IRA?

When it comes to securing your retirement and your family’s financial future, Individual Retirement Accounts (IRAs) can be a real game changer. What makes these special accounts so enticing is the ability to set aside tax-deferred savings for use in the future. But, as with any long-term investment, it’s crucial to allocate a significant portion of your assets to investments that are dependable and reliable.

You can include cash, stocks, ETFs, and other assets in an IRA, but cash is devaluing rapidly and inflation is out of control. Your savings could be worth far less in the future if you don’t have something tangible to back it up with. What you need is an asset that retains its value and even increases in value over time. And, let me tell you, there’s no better investment option for this than gold.

With the world’s economy currently going through lockdowns, shortages, wars, inflation, and a looming recession, the level of uncertainty has never been higher. Now more than ever, investors are placing physical gold in their IRAs to protect their financial future. A Gold IRA investment has proven to be a great hedge against crises that negatively affect most other assets.

When it comes to risk, it’s important to understand the economic climate. But, with gold, you can rest easy knowing you have an asset that is always in demand and retains its value over time. Plus, gold is perfect for diversification to protect against potential losses in other investments.

It’s worth noting that a Gold IRA can be a smart investment strategy, but it’s not suitable for everyone. Before making any decisions, it’s a good idea to consult with a financial advisor to determine whether a Gold IRA is the right choice for your particular financial situation.

Where should I store the gold in my IRA?

The IRS has laid down strict regulations stating that any bullion in your IRA account must be stored with a certified depository. This means that you cannot simply stash your gold bars in a home safe, or under your bed for safekeeping. Instead, a separate entity will need to be in charge of managing and securing your precious metals, while your Custodian takes care of your daily paperwork.

Thankfully, most reputable Gold IRA companies have partnered with trustworthy custodians who will ensure that your metals are stored safely. These custodians are carefully vetted and have a proven track record of providing excellent storage solutions for their clients. However, if for some reason, you are not satisfied with any of the partnered custodians, you have the option of introducing your own compliant depository to the mix.

When looking for a depository, it’s essential to ensure that it meets all regulatory requirements. Some of the top depositories in the market include Brink’s, Delaware Depository, and IDS. While all three offer top-notch storage options, it’s worth noting that IDS is the only one that provides segregated storage. However, regardless of the depository you choose, all three offer similar bonuses and are recognized for their reliability and security. So be sure to explore your options and find the best storage for your IRA gold.

When can I take distributions?

If you are at the qualified age to start getting disbursements from your account (usually 59 ½ ), you can choose to take funds in cash value. Or you can have the actual metals shipped to you directly.

But be aware that you will be taxed accordingly and be responsible for any liability to the IRS for early withdrawals. The bottom line is that you should treat a Gold IRA as a long-term investment for retirement and hold it to maturity. But remember that you have to start taking payments at 70 ½.

Is a Gold IRA a safe investment?

Let’s turn this question around and ask: “Will your IRA really be safe without gold?”

Because gold prices historically move in the opposite direction of paper assets like stocks and bonds, adding a Gold IRA to a retirement portfolio adds diversification and also provides an insurance policy against inflation.

This minimizes risk, especially over the long term, which makes it a smart choice for retirement investments like IRAs. For more details, you can visit our article on gold IRA pros and cons.

What types of retirement accounts can be transferred to a Gold IRA?

You can transfer any type of retirement account, including a Traditional IRA, Roth IRA, 401(k), or other pension plans, to a Gold IRA as long as the account custodian or trustee allows it.

Here’s the complete list of transferable retirement accounts:

- Employer-sponsored 401(k)

- Self-directed 401(k)

- Traditional or Roth IRA.

- TSP

- 403(b)

- 457(b)

- SEP IRA

If you still have questions, read more Gold IRA FAQs.

| Augusta Precious Metals | Goldco |

| >> Get paid in REAL Gold | >> Get 10% back in FREE silver |

|

|