To ensure you’re working with a reputable precious metals company, we have reviewed and rated the 9+ best precious metals IRA companies for 2025 to help make your decision easier!

>>See our list of the top 9+ precious metals IRA companies (cash sales also available).

Or, check out a time-limited special promotion from our #1 recommended company!

For a limited time, they are offering up to 10% of your order in FREE silver! Meaning that if you purchase metals for $100,000, you get $10,000 in FREE silver!

>>Learn more about this special promotion here!<<

American Coin Co. is a company we don’t mind recommending to any physical precious metals investor. As we get into what the company is about and some of their unique promotions, you’ll see why they stand out as both a precious metals IRA manager and a plain old bullion vendor.

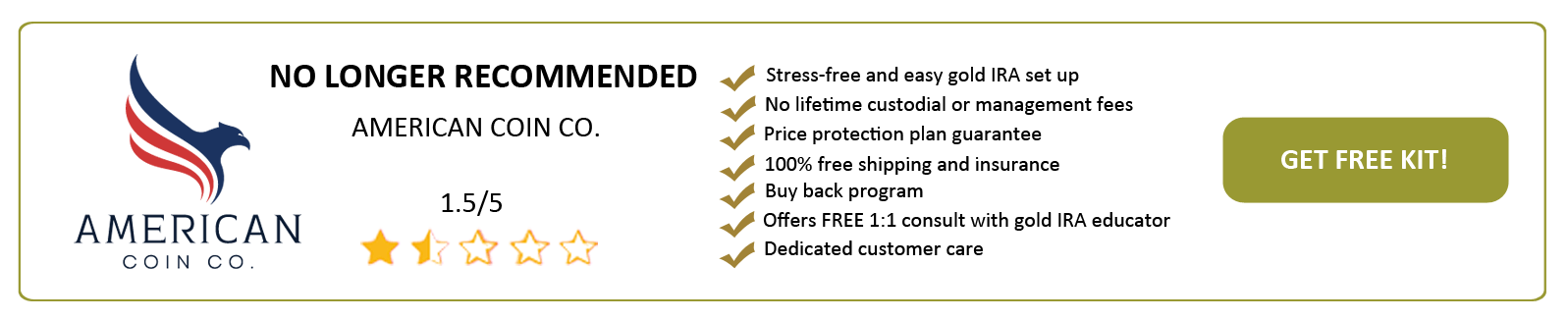

If you do not wish to read the full review, let us start with a quick summary of our review:

The company provides secure, discrete, fully insured shipping on your order, so you can invest with confidence. What’s unique for American Coin Co. is their zero out-of-pocket fees when you establish and fund your account with a trusted custodian. 90% of clients qualify for American Coin Co. to cover their administration and storage for a minimum of one to 10 years; many qualify for no fees for life.

Additionally, their price protection plan ensures that if the price of gold or silver should decline within seven days of your purchase, American Coin Co. will cover the difference in more precious metals on qualified accounts.

American Coin Co. Promotions

● Up to $25K in FREE Silver *on qualifying accounts*

● Free Dedicated Gold & Silver Educator – one-on-one learning sessions

● Price protection plan guaranteed to match or beat any competitor

Since this is a comprehensive review, you can use the quick links in the TOC list to jump straight to any section:

| American Coin Co. | Products Available: |

| 601 W 1st Ave. Suite 1400, Spokane, WA 99201www.americancoinco.com |

– Premium Precious Metals – Self-Directed IRA |

Pros And Cons Of American Coin Co.

- IRA-eligible bullion in all four precious metals categories

- Price protection plan within seven days of purchase

- Zero management fees for any account services

- No custodial and management fees for up to 10 years

- A $25,000 in FREE silver promotion (for qualifying accounts)

- Free virtual educational webinars, plus one one-on-one consult with a Gold IRA Educator

- Though they say IRAs are only half of their business, their attention toward retirement investors is clear

- Lawsuit warning!

- Limited information on their website

- Can’t sign up for a gold IRA account online

With that quick overview, let’s take a closer look at the company’s history.

Company Background

American Coin Co. is a reputable precious metals investment firm that specializes in gold and silver IRAs. It caters to knowledgeable investors looking to diversify their wealth.

American Coin Co. is a reputable precious metals investment firm that specializes in gold and silver IRAs. It caters to knowledgeable investors looking to diversify their wealth.

The company’s mission is to help every American enjoy a worry-free retirement and leave a legacy for their loved ones. It’s also a supporter of the K9s for Warriors program.

With this in mind, American Coin Co. is dedicated to assisting clients in protecting, controlling, and growing their wealth through the use of precious metals.

The team at American Coin Co. takes pride in their customer-centric approach, providing educational resources to ensure clients can make informed purchases and receive long-term support and security.

American Coin Co. Leadership

Brett Bultje serves as the Vice President of Sales at American Coin Co. As an expert in the field, Brett provides valuable informational webinars to investors on a weekly basis. With over a decade of experience, his dedication lies in guiding Americans toward wise investments in gold and silver.

Brett Bultje serves as the Vice President of Sales at American Coin Co. As an expert in the field, Brett provides valuable informational webinars to investors on a weekly basis. With over a decade of experience, his dedication lies in guiding Americans toward wise investments in gold and silver.

Alongside his commitment to process improvement and his Six Sigma White Belt training, Brett is focused on establishing a compliant culture within the firm.

Prior to his career in finance, Brett excelled as an athlete, becoming a Colorado 3A State Champion and a two-time collegiate Track & Field National Champion. Additionally, he has completed the LA Marathon three times.

Price Protection Plan

Never zero is an almost unnecessary label when it comes to naming a precious metals price-protection policy. Precious metals only ever lose so much, and since they’re meant to be viewed strictly through a long-term prism, the losses are mostly seen as temporary.

Nonetheless, American Coin Co. has implemented a unique promotion for those concerned over their losses when investing in precious metals. The exact details aren’t clear, but the company tells us that as many as 90% of their customers qualify for the price protection plan, which lasts for a week.

It’s a pretty straightforward one: if you do qualify for the price protection plan, American Coin Co. will reimburse whatever losses you had in your first week of investment with non-cusip gold or match the competition. In case you aren’t familiar, non-cusip gold basically means gold that isn’t traceable or is less traceable than other forms, making it the preferred choice for many investors.

While some might find it better to be reimbursed with cash, since you’re already in precious metals investment, gold should do just fine as well. As for the one-week period, you might be surprised by how much gold you could end up getting from this protection: the metal has been known to gain anywhere between 10% to 20% within a week’s span.

For example, if you purchase $100,000 in precious metals and the market drops 10% the next day, American Coin Co. will compensate you $10,000 in additional metals to cover the loss. *Applies only to non-CUSIP transactions.

To be sure, it can amount to quite a bit of gold, and it’s a promotion, unlike anything we’ve seen in any other company.

Client Educational Approach

American Coin Co.’s website obviously makes it clear that client education is a priority. The aforementioned case of non-cusip gold is an example: a lot of competitors won’t even mention this or outline why it’s important.

In what is a pretty recurring theme with the company, American Coin Co. has dedicated an entire page to explaining the importance of non-cusip gold. Plenty of informational articles of different kinds can be found on their website.

Another thing that might be worth mentioning is that one of their promotions includes a “white glove service” for customers whose investment minimum exceeds $100,000. If we had to guess, we’d assume this entails an even greater and tailored educational approach, though it must really be going the extra mile since their base offering is as good as it is already.

How To Start A Gold & Silver IRA American Coin Co.

The process of starting a gold & silver IRA is streamlined with most companies of this kind, and the same is true for American Coin Co.

The process of starting a gold & silver IRA is streamlined with most companies of this kind, and the same is true for American Coin Co.

Once you’re interested in opening a precious metals IRA, you either request their Free Gold & Silver Guide or reach out to American Coin Co. and speak to one of their representatives over the phone.

The application requires your name, address, phone number, and email address. Once the company receives your application, one of their representatives will reach out to you for a complimentary consultation. During this consultation, they will discuss whether investing in gold or precious metals aligns with your future goals. Your representative will guide you through American Coin Co’s three-step investment process.

After the account is open, you’ll use the funds from one or more liquidated employer-sponsored plans and existing IRAs to purchase the physical precious metals of your choosing. They’ll be shipped to the depository of your choice, and your new retirement account will be ready.

From there, you can either treat the IRA as you would any employer-sponsored plan or a portfolio you constantly make adjustments to. Some like a hands-off approach, others prefer to be up to speed regularly, and American Coin Co. is there to cater to investors of all kinds.

Plus you can expect to have dedicated customer support for as long as you have an account opened with the company.

Gold & Silver IRA Setup Process

Here’s the process in short:✓ Learning

First, request the Free Gold & Silver Guide and learn about gold and silver investments in an IRA.

✓ Goal Setting

Connect with a dedicated Gold & Silver Educator. They are ready to answer any queries, assist in defining your goals, and identify the investment options that best align with your requirements.

✓ Precious Metals Purchase

After determining the most suitable metals for your goals, you will collaborate with an assigned rollover specialist who will guide you through the tax-free, penalty-free process of transferring funds into a self-directed IRA. This IRA allows you to securely hold physical gold and silver.

✓ Metal Delivery

Once your self-directed IRA account is funded, your order can be shipped to a secure physical storage facility, your chosen custodian, or directly to your residence. All shipping costs are covered, your order is fully insured, and the packaging ensures utmost discretion. American Coin Co. transports your investment to a secure storage facility insured by Lloyd’s of London. Or, to your home, if you choose a home storage gold IRA.

If you’re ready to take action, >>>request the Free Gold and Silver Guide.

Precious Metals IRA Storage And Home Delivery

If you’re opening a precious metals IRA, you’re going to want your precious metals stored in a third-party depository according to the government’s guidelines.

American Coin Co. mentions Brink’s and the Delaware Depository as examples of depositories they work with while adding that they’re open to working with another approved facility of your choosing. Plenty of precious metals investors want their bullion as close to home as possible, and being able to choose a state that’s nearby is great.

If you’re buying precious metals outside of an IRA, as mentioned above, American Coin Co. will have them shipped to your home address free and insured. Delivery times can obviously vary, but the company does mention that they focus on fast shipping, and it probably shouldn’t take much longer than a week for the physical precious metals to arrive.

American Coin Co. is perhaps the only reputable company we’ve come across that also offers a home storage gold IRA. This is a very difficult endeavor that you almost certainly won’t qualify for, so it’s barely worth mentioning. However, a brief mention of them facilitating it through a reputable custodian to those who do qualify is still warranted.

Custodian

American Coin Co. lists Equity Trust as their preferred custodian, along with mentioning Kingdom Trust as being the firm that facilitates the home storage gold IRAs opened through them.

As in the case of depositories, they reveal that they’re open to working with other custodians based on the customer’s preferences and finding one that’s more to your liking if you’d rather not go with Equity Trust. In general, though, it’s one of the largest custodian firms, making it a good choice for most.

Annual Fees And Investment Minimums

Here’s what you can roughly expect in terms of fees and investment minimums when doing business with American Coin Co:

- There are no charges for setting up a precious metals IRA or rolling over a retirement account. Additionally, every transaction made through American Coin Co. includes 100% coverage of shipping and insurance costs

- When you establish and fund your account with a trusted custodian, there are no out-of-pocket fees

- Furthermore, qualifying clients may have their administration and storage covered by American Coin Co. for a minimum of one to 10 years. Take advantage of our ‘No fees for life’ promotion available on qualifying purchases

- American Coin Co. does require a minimum of $2,000 for cash-only investments and a $10,000 minimum for IRA investments

Transaction Time

Cash transactions can take as little as 24 hours from contacting American Coin Co. to receiving the shipped metals.

The timing of IRA or 401(k) transfers and rollovers varies depending on your financial institution, but the processing paperwork typically takes about 15 to 30 minutes.

American Coin Co. Precious Metal Products

American Coin Co. has a pretty minimal approach to the product listing, giving a list of everything that’s available on a single page.

Here’s what’s listed on the site (you can also schedule a time with them for a metals assessment):

Gold Coins

1-oz Silver American Eagle

Gold American Buffalo

Gold American Eagle

Red Lion Gold Coin

Red Tailed Hawk

Silver Coins

Silver Canadian Red-Tailed Hawk

Silver American Eagle

Red Lion Silver Coin

Silver Soveriegn

90% Silver US Coin or Junk Silver

Palladium Coins

American Palladium Eagle

Platinum Coins

American Platinum Eagle

American Coin Co. Reviews & Complaints

![]()

Being an upcommer in the Precious Metals IRA niche, American Coin Co. hasn’t collected any customer reviews and ratings yet. We will continue to monitor all the popular online watchdog sites and update this review with customer reviews and ratings as the company grows.

Just like reviews, there are no complaints to be found online, which is a good thing.

American Coin Co. FAQ

Where Is America Coin Co’s Headquarters?

Like most companies of this kind, American Coin Co. is headquartered in Washington DC. From there, it serves customers from all 50 states regardless of whether they want to open a Gold IRA account or simply purchase precious metals from a reputable dealer.

How Does America Coin Co. Store My Gold?

American Coin Co. uses a reputable third-party depository, such as Brink’s or the Delaware Depository, to store gold in nearly all of the precious metals IRAs they manage. They can use another approved depository of your choosing, should you so desire it. In the rare cases where it’s possible, American Coin Co. can also facilitate a home storage IRA, though this is only really doable by those who already have some kind of custodial firm.

How Much Does It Cost To Open A Gold IRA With American Coin Co?

American Coin Co. sets a minimum investment requirement of $2,000 for cash investors and a minimum of $10,000 for IRA contributions. The company handles all application fees, startup costs, management, and custodial fees (if the preferred custodian is chosen).

Additionally, there is an annual depository fee of $200; however, eligible customers may qualify for a fee-free alternative.

How Long Does The American Coin Co. Gold Buying Process Take?

Buying bullion outside of an IRA is generally completed in a day, with the metals being shipped to you 24 hours from the time you completed the order through a call. Precious metals IRAs opening windows are a bit trickier to pinpoint. You could have all the paperwork ready and have the IRA up and running in 30 minutes, or it could take a week or even longer for the custodian to ensure there aren’t any oversights.

What Metals Can I Get From American Coin Co.?

Gold, silver, platinum, and palladium are all a native part of American Coin Co’s inventory. There are plenty of interesting products on offer in each of the four categories, and you should find something to your liking regardless of how picky you are when it comes to your physical precious metals.

Can I Hold My Precious Metals?

Yes, American Coin Co. offers customer visits to its depositories, where investors have the opportunity to hold their precious metals securely.

Verdict: Is American Coin Co. A Legit Gold IRA Company?

No! We don’t recommend doing business with American Coin Co. based on their recent lawsuit. The company’s website isn’t even operational at this time of writing. For a safe investment, please have a look at the alternatives below.

American Coin Co. Alternatives

If you want to look around a bit more before making a final decision on what gold IRA provider to choose, we have reviewed and rated the best gold IRA companies for 2025. You can request their gold IRA kits directly from the reviews table below:

>

Do you not do any research? This company is RedRock Secured rebranded. RedRock Secured is under investigation by the CFTC and SEC for scamming clients of their hard earned retirement funds.

STAY AWAY!!!