Are the few Goldco complaints on online consumer watchdog sites anything to worry about? The simple answer is NO!

And this article will show you exactly why!

In this post, we’ll take a look at Goldco’s customer complaints, ratings and reviews on the BBB and BCA to judge whether Goldco is a legit precious metals company and if it’s safe to buy gold and silver from them.

Before we take a closer look at these questions, let’s start with a brief company introduction.

Company Background

Goldco is the leading precious metals and gold IRA company in the US. Trevor Gerszt has been running Goldco for over a decade now.

The company has its headquarters in Calabasas, California, and is a full-service precious metals company that specializes in gold or precious metals IRAs.

The company has its headquarters in Calabasas, California, and is a full-service precious metals company that specializes in gold or precious metals IRAs.

They also sell precious metals coins and bars directly to customers and offer the highest buy-back price guarantee on the market. And their goal is to make gold and silver investments easy, seamless, and secure.

The company has helped thousands of people to diversify, grow, and protect their wealth with physical metals such as gold, silver, platinum, and palladium for over a decade now.

Goldco’s Mission Is To Help Americans Protect & Secure Their Retirement Savings

All in all, Goldco’s mission is to help Americans protect their retirement savings accounts from stock market volatility and inflation through the use of precious metals.

Its specialty has always been the sale and delivery of premium gold and silver coins that are IRA-approved, and in helping you identify which precious metals are right for you.

Now that you know a little bit about the company, let’s dive straight into Goldco’s complaints to ease any potential worries about this top-rated precious metals and gold IRA company.

Goldco Complaints

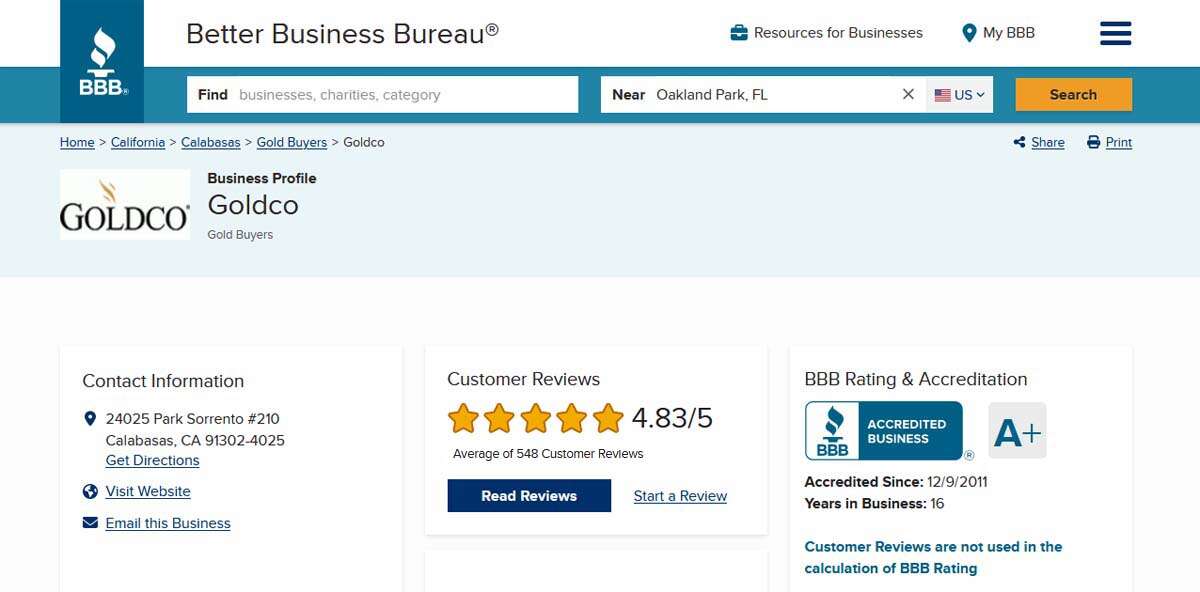

During the last 3 years, Goldco has had 26 customer complaints on the Better Business Bureau, and 11 complaints have been closed in the last 12 months.

Customers have mostly been upset over gold and silver being purchased over the spot price or not being entitled to their silver coins bonus, which has been resolved.

Additionally, on the Business Consumer Alliance (BCA) page, they’ve had 1 customer complaint in the last 3 years that’s also been closed.

We consider this normal and reasonable with all years the company has been in business. There are always going to be some customers that aren’t happy no matter what business you’re running.

If you’re ready to take action, >>> request your FREE Special Bank Bailouts Report!

Goldco Customer Reviews & Ratings

Apart from the company’s few complaints, Goldco’s customer reviews and ratings are phenomenal and the company remains greatly respected in its industry despite over a decade in business.

Here’s a quick overview of Goldco’s recent customer reviews and ratings:

To give you a better overview, here’s a sample of some recent, verified Goldco reviews from Google, BBB, and Consumer Affairs:

If you’re ready to take action, >>> request your FREE Special Bank Bailouts Report!

Is Goldco Legit?

Yes, it is safe to say that Goldco is a legit precious metals company. As already mentioned, Goldco is rated A+ by the Better Business Bureau and has a Triple-A rating from the Business Consumer Alliance based on positive customer reviews of their service, dependability, and ethical business practices.

With over a decade in the industry, they have few complaints and thousands of 5-star reviews on popular consumer watchdog sites, which is a good accomplishment in today’s internet era where people easily can raise their thoughts and concerns about any company online.

Additionally, Goldco was honored as the Company of the Year in the 2021 American Business Awards and is also endorsed by Sean Hannity and Stew Peters.

On top of that, the popular actor and martial arts artist, Chuck Norris, has endorsed Goldco as the only trustworthy company for gold and silver purchases. You can even buy the Chuck Norris Limited Edition 1 oz Silver Coin that represents his five principles for life: Faith, Family, Fitness, Freedom, and Fight.

On top of that, the popular actor and martial arts artist, Chuck Norris, has endorsed Goldco as the only trustworthy company for gold and silver purchases. You can even buy the Chuck Norris Limited Edition 1 oz Silver Coin that represents his five principles for life: Faith, Family, Fitness, Freedom, and Fight.

Reasons To Choose Goldco

Except for the above, here are other reasons to choose Goldco as your precious metals company:

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry (for example, you can get up to 10% of your order in FREE silver)

- Unmatched Customer Service

- No High Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

- 2021 Company Of The Year Award

>>> For more information, you can read our in-depth Goldco review.

How To Know If A Company Is Legit?

It is always important to thoroughly research a company before doing business with them and to be cautious of any company that you are unfamiliar with.

There are a few steps you can take to help ensure that a company is legitimate:

- Check their website: Is the website professional and well-designed? Do they provide detailed information about their products or services, as well as clear contact information?

- Look for online reviews: Do other customers have positive experiences with the company? Are there any red flags or warning signs in the reviews?

- Check with regulatory organizations: Is the company licensed or registered with the appropriate regulatory organizations in your area?

- Be wary of unsolicited offers like self storage gold IRAs: If you are contacted by a company that you are not familiar with, be cautious of any offers or requests for personal or financial information and illegal activities like home storage gold IRAs.

- Trust your instincts: If something seems too good to be true or you have any doubts about a company’s legitimacy, it is usually best to avoid doing business with them.

If you’re ready to take action, >>> request your FREE Special Bank Bailouts Report!

Top 6 Precious Metals Companies

To help you identify the best option to protect and grow your wealth, we have reviewed and rated the top 6 precious metals and gold IRA companies in the industry.

We have rated each gold IRA company on a variety of factors including BBB/BCA ratings and complaints, customer reviews, annual fees, precious metals selection, storage options, promotions, and buy-back programs. You can request their information kits on precious metals investments directly from the review table below by clicking on the “Get Free Kit” button to the right:

Not only do we provide a

Not only do we provide a